Scam Alerts

8 Scams That Senior Medicare Patrols Are Seeing Now

Old deceptions are recycled to take advantage of what you know from news reports

Identity Fraud Cost Americans $43 Billion in 2023

Victims are losing more money to these crimes, a new AARP-backed report finds

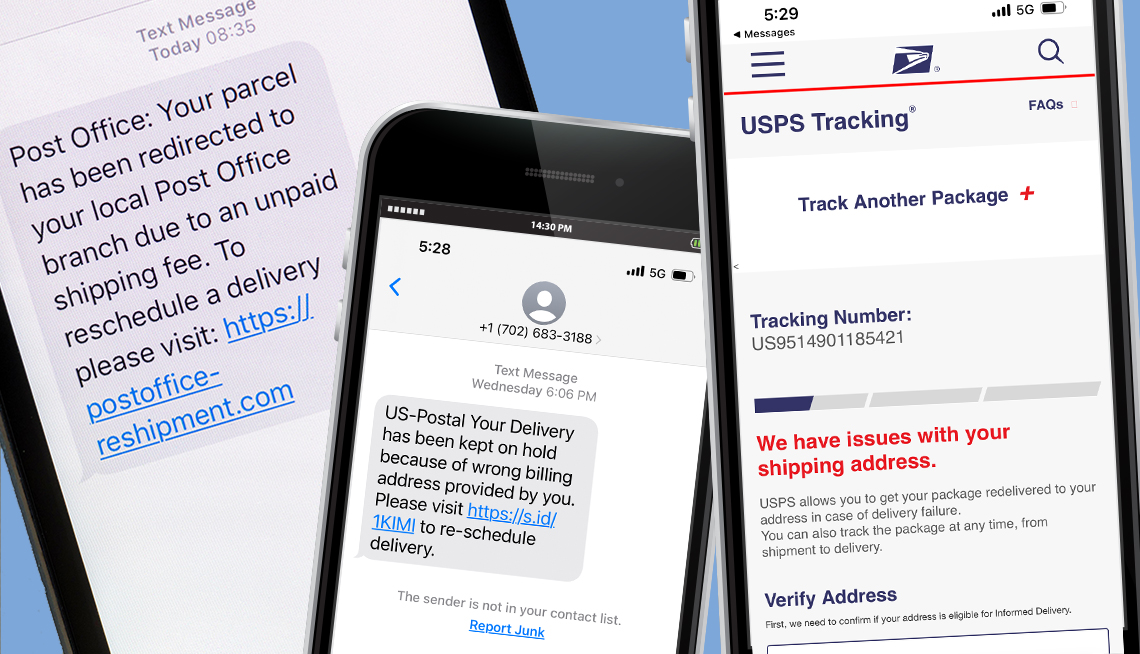

Fake Delivery Service Text Alerts Are Rampant

How to tell if messages are legitimate or criminals’ smishing attempts this holiday season

Is That Your Bank Contacting You — or a Scammer?

Criminals pretend to warn you about fraud while trying to steal your money

Beware of ‘Do Me a Favor’ Scam Messages

An increasingly common scheme involves impostors claiming to need help buying gift cards

How to Avoid Scams on Zelle, Venmo and Other P2P Apps

Criminals love peer-to-peer payment methods; learn to use them safely

6 Top Scams to Watch Out for in 2024

Criminals are getting more sophisticated and supercharging old scams with new technology

Scammers and Celebrity Impostors Defraud Fans

Singers Blake Shelton and Dolly Parton are among the many stars impersonated

Fraud Fighting

What to Do if Your Wallet Is Lost or Stolen

7 steps to prevent identity theft and money loss — plus how to replace what’s missing

How to Avoid Scams on Facebook Marketplace

Scammers aim to take advantage of both buyers and sellers. Here’s how to spot and avoid them

Avoid Real Estate Wire Fraud When Buying a Home

A New Jersey couple lost nearly $92,000 to scammers — and they’re not alone

How, Why and When to Check (or Freeze) Your Credit Score

Monitoring your creditworthiness is key for tracking your financial health and spotting fraud

10 Worst Things to Carry in Your Wallet

With identity theft rampant, keep only the essentials in your pocket or purse

White House Announces New AI Protection Efforts

Measures meant to prevent fraud, keep infrastructure secure and protect privacy

Victim Support

AARP's Fraud Watch Network Helpline Is Fighting for You

Volunteers provide emotional support and practical advice to scam victims

3 Ways to Help a Loved One Who Has Been Victimized

Ease the burden on your friend or family member by offering compassion, assistance

Elder Fraud

The Legal Consequences of Elder Fraud Can Be Steep

Scams are on the rise, but here are ways to fight back

More on Fraud

Should You Stop Using Paper Checks?

Other forms of payment may be safer as mail theft and check-washing cases surge

12 Gripping Shows and Movies About Scams to Stream Now

Stories of brazen criminals abound on Netflix, Hulu, Amazon Prime and more

What I Learned After Hackers Attacked Me and Stole $4,000

It took dozens of hours to fix the onslaught on my accounts by cyberthieves

Physical Security Keys Offer Protection from Scammers

The pros and cons of using hardware keys to secure your digital life

What to Do After You’ve Experienced a Scam

Take these steps to protect your bank accounts and personal information, and find the support you need

How Much Do You Know About P2P and Crypto Scams?

Take this quiz to see if you are savvy about tools like Zelle and Venmo, and why criminals

Glossary of Scam and Fraud Terminology

From A to Z, here’s a guide to the frequently used lingo of deception