AARP Hearing Center

The Stock Market Plunge: What You Should Do, or Not Do

By Allan Roth, August 24, 2015 05:17 PM

The headlines are brutal:

It’s enough to get anyone to panic and sell. And that, in my opinion, would be exactly the wrong thing to do. It’s not that I have a clue whether the current market plunge is a minor setback for stocks or the beginning of the third half-off sale this century. Rather, I know that it’s our fair weather human nature to embrace risk in boom markets and shun risk when markets tank.

Get the latest tips on protecting your money and saving for retirement — AARP Money newsletter »

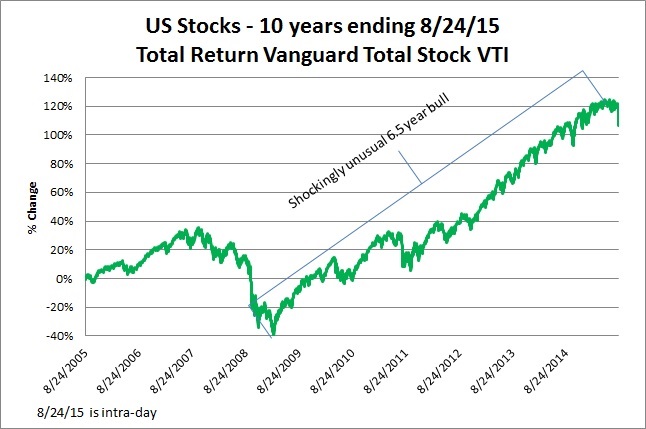

First and foremost, it’s important to have some perspective. As of the time of this writing, U.S. stocks are down just under 5 percent for the year, as measured by the Vanguard Total Stock Index Fund ETF ( VTI), including reinvested dividends. Even placing this in the context of a few months, it’s not exactly a “market plunge.” After six consecutive up years, we tend to expect more of the same, which makes us think we are more risk tolerant than we really are. In reality, as stocks get more richly valued, a correction or bear becomes far more likely. Thinking in terms of what has happened over a few days ignores any long-term perspective.

While I don’t know the short-term future of the stock market, I know something almost as important. If markets really do plunge, I know many people will panic and sell, repeating the same mistakes made after the bursting of the tech and real estate/financial bubbles. The good news is that this creates an opportunity for investors to buy when stocks are on sale. Data is very conclusive that individual investors underperform markets by roughly 1.5 percent annually by poor market timing. That is to say, on average, we buy after stocks have surged only to sell after a plunge. It's very human but also very illogical.

Though it may appear that what has been going on over the past few trading days is extreme, corrections and bear markets are part of investing. I actually think a sustained six-year-old bull market, with rarely a single correction, is what is extreme. Earlier this year, I advised people not to expect the bull to continue.

What to do

What I’m doing right now with my own portfolio is a whole lot of nothing. Knowing how risky stocks can be, my own portfolio is only 45 percent in stocks. A 5 percent decline in stocks only moves my allocation down by about 2 percentage points. That is not enough for me to rebalance as of now. If stocks decline much more, however, I’ll have to sell some of my boring bonds to buy more stocks. And if they continue to fall further, I’ll do more of the same. That will, of course, be going against the herd and that, in the long run, typically works out better. It certainly did in the wake of the last two bubbles.

Get discounts on insurance and banking services with your AARP Member Advantages. »

So my advice is to stick to a portfolio allocation. That means picking an allocation conservative enough to leave you with the cash and courage to buy more stocks the more they decline. The hard part will be ignoring all of the frightening headlines.

I’d be lying if I said I’ve felt no pain over the past few trading days. It hurts and I hate it. Yet I know that a key component of investing is handling the pain. What has happened over the past few days is a cakewalk compared to the last bubble that popped in 2008 and 2009. You shouldn’t be in stocks if you can’t handle this pain.

Featured image allkindza/iStock ; chart Wealth Logic, LLC with data from Yahoo Finance.

Also of Interest

- Stocks for the long run? Really?

- 10 budget U.S. trips to take in 2015

- Quiz: How much do you know about credit and debt?

- Join AARP: Savings, resources and news for your well-being

See the AARP home page for deals, savings tips, trivia and more.