AARP Eye Center

Dad's Legacy of Debt Inspired a Movement

By Deb Silverberg, June 14, 2013 08:36 PM

This is a guest post by Jeff Rose.

Fathers tend to leave lasting memories behind for their children. Fond summer memories for some might involve playing catch or 'HORSE' basketball, going fishing, or grilling hot dogs that tasted just right. For me, my father's legacy was debt.

Growing up, my father gave me everything: love, support and understanding. I cherished every moment with him and I wouldn't trade those experiences for the world.

When I got older that I started to realize that my dad had a problem. It wasn't drugs, or smoking. It was debt.

Related: Parents, Get Your Financial Life In Order. Then Talk to Your Kids.

My dad constantly struggled with debt as far back as I can remember. I can still picture him at the computer with a white sheet of paper listing his credit card interest rates -- some as high as 24 percent. He often had to take a cash advance from one card to pay the minimum on another.

His debt problem was so bad that not only did he file for bankruptcy once, but then managed to rack up even more credit card debt and had to file bankruptcy a second time.

When he finally passed away, he passed away in debt.

One of the biggest regrets that I have is never asking my father why he struggled with debt. Why he could never take charge of his financial situation and prevent himself from plunging further into the debt abyss. To this day, that is my regret. Living your life with a regret that you can no longer fix is a horrible feeling.

Knowing that I can't have that conversation with my father has made me want to help people not travel down this same path. I know that my father is not the only one who has struggled.

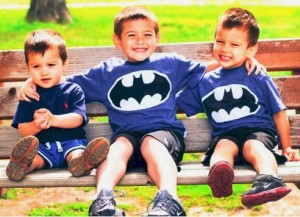

Debt has no age boundaries. Debt affects multiple generations of families. Sadly, more older Americans are in debt than ever before. I decided long ago not to pass on my dad's legacy of debt to my own boys (above).

I started The Debt Movement to try to help other families and individuals not struggle like my own dad did, and my goal is to help people pay off a total of $10 million of debt by the end of the year. (

And if debt isn't a problem for you but it is for others in your family, please share this post with them as food for thought.)

As part of The Debt Movement I have partnered with ReadyForZero and a hundred other financial bloggers and financial service companies to give people the tools, resources, and motivation they need to finally get out of debt.

AARP also has helpful information and resources to pay down debt and manage credit.

If you or your loved ones are in debt, I encourage you to talk openly and honestly and support each other to break the vicious cycle of debt. We have the power to decide what kind of legacy to leave our kids and grand kids, and they deserve better from us.

Also of Interest

- Debt Is a Taboo Conversation Topic

- Mulling a Payday Loan? How Does 322% APR Sound?

- Join AARP: Savings, resources and news for your well-being

See the AARP home page for deals, savings tips, trivia and more