AARP Eye Center

Schwab Starts No-Fee Investment Service

By Rick Levinson, March 9, 2015 02:58 PM

The investing world has been all atwitter — or a tweeter — over the coming of Charles Schwab’s Schwab Intelligent Portfolios, which opened to the public today.

The new service from the San Francisco-based money manager is the latest in the growing world of “robo-advisers,” or investment advisory solutions that rely on computer algorithms to build, monitor and rebalance portfolios based on your stated goals, time horizon and risk tolerance. Online competitors include Betterment, Wealthfront, SigFig and others, which have varying fee structures depending on how much you invest. But given Schwab’s size (about $2.45 trillion in assets managed), any new offering from the firm gets a lot of attention.

AARP Foundation Tax-Aide: Get free help preparing and filing your taxes »

What’s more, the Schwab service is free of advisory fees, commissions or account services charges. But wait a minute, where’s the catch? We all know there’s no free lunch in the financial services world.

So of course there is one — or two. The Schwab portfolios require you to keep a certain percentage in cash, which will pay you essentially bupkis in interest while the firm gets to use that money. It remains to be seen how big an effect this will have on performance. The firm also earns revenue from “managing Schwab ETFs,” or exchange-traded funds, “and providing services relating to certain third-party ETFs that can be selected for the portfolio,” according to its disclosure statements. There’s also a limit to how much personalization you can do on your own; in other words, you have to live with the choices they’ve selected unless you change your risk profile. (A company spokesperson says you can swap out as many as three funds from the portfolio with backup choices they provide.)

Schwab will use only exchange-traded funds to make up the portfolios, using third-party providers including Vanguard, iShares and PowerShares as well as its own branded funds, which generally have low operating expense ratios. So that’s good.

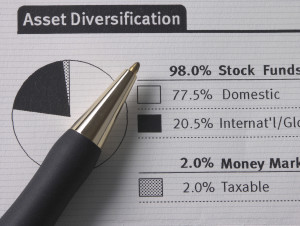

Schwab also says the investments will be spread among stocks, fixed income, real estate and commodities across U.S. and international markets in an effort to reduce volatility and keep the portfolios diversified. Another good thing.

Get discounts on financial services with your AARP Member Advantages. »

It also promises automatic rebalancing when your portfolio drifts too far from your stated goals — yet another plus, because many self-directed investors get tripped up by inertia, fear, etc. when it comes to reallocating investments.

Whether that all adds up to the Next Big Thing or not depends on whether the average investor embraces it. Schwab said on a conference call today that it has over $1 trillion in self-directed accounts now, so that’s a pretty big sandbox. Let us know what you think.

Photo: istock

Also of Interest

- One Older Worker’s Saga to Find a Job

- What's the Maximum Social Security Benefit?

- Get Involved: Learn How You Can Give Back

- Join AARP: Savings, resources and news for your well-being

See the AARP home page for deals, savings tips, trivia and more