Scam News and Alerts

Five of the Biggest Scams to Watch for in 2025

Old frauds don’t disappear — they become more sophisticated. Here’s how to protect yourself this year

Scammers Use ‘Pig Butchering,’ to Steal Savings

The terrible term describes a key tactic for criminals perpetrating investment scams

$12.5 Billion Reported Lost to Scams and Fraud in 2024

The FTC announces record losses as the scam epidemic shows no sign of abating

Online Sports Betting Can Be a Gamble as Scams Flourish

Older bettors may be more vulnerable as criminals look to profit from the multi-billion-dollar industry

The Rise and Fall of a Ponzi Schemer

A charismatic scammer stole millions from dozens of “friends” until his ruse fell apart

Americans Flooded With Road Toll Scam Texts

Criminals pretend to be from electronic toll-collection services to steal data and money

New Laws Allow Banks to Pause Suspicious Transactions

State lawmakers hope that the legislation can protect customers who may be in the midst of a scam

Anyone Can Be a Target for Sextortion

Scammers solicit compromising photos online, then blackmail victims

Fraud Prevention

Follow This Advice Before Accepting a Stranger’s Check

Criminals take advantage of the delay before a payment clears

How to Manage Relationships With Chronic Scam Victims

Sometimes a loved one refuses to or can’t see that they’re the victim of a scam

What to Know About Credit Card Skimmers

7 tips to protect yourself from criminals who install skimmers on card readers to steal users’ cash

Another Darn Breach? How to Protect Your Personal Data

Your information is likely out on the dark web, but you can still take steps to minimize risk

How, Why and When to Check (or Freeze) Your Credit Score

Monitoring your creditworthiness is key for tracking your financial health and spotting fraud

AARP's Fight Against Fraud

AARP Backs Laws Targeting Criminals Who Use Crypto ATMs for Scams

New state legislation aims to protect older adults from this growing method of fraud

Broad Approach Needed to Combat Fraud, AARP Tells Congress

AARP addressed financial fraud's devastating impact on older adults

More on Fraud

Title Fraud Thiefs Steal Your Identity — Then Your Home

Criminals can use public information to victimize both buyers and owners in this real estate scam

Are You a Scam Victim? You Might Get Hit Again by Taxes

Advocates are working to change federal laws to separate fraud losses from taxable income

What to Know to Protect Yourself Against Bank Scams

It can be hard to tell whether you’re being contacted by your bank or a criminal

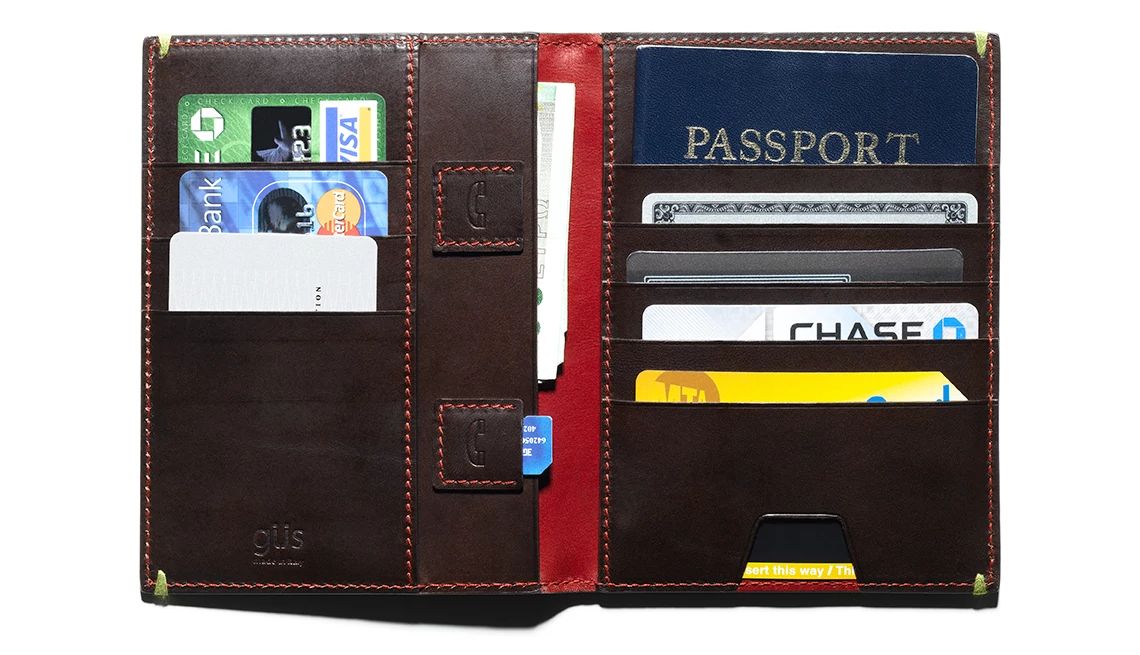

Do You Really Need an RFID-Blocking Wallet or Purse?

Experts say not to waste your money — but warn that thieves can swipe your data in other way

What to Do After You’ve Experienced a Scam

Take these steps to protect your bank accounts and personal information, and find the support you need

15 of the Worst Things to Keep in Your Wallet

With identity theft rampant, keep only the essentials in your pocket or purse (Members Edition)

How to Avoid ‘Wrong Number’ Text Scams

Crooks pretend to contact you accidentally to lure you into a crypto investment or other scheme

Keep Those With Cognitive Decline Safe From Scams

Key steps to protect vulnerable family members’ finances in an age of rampant fraud

‘Shark Tank’ Stars Fed Up as Scammers Use Their Images

Criminals manipulate their photos and videos in ads for weight-loss products, keto gummies

Glossary of Scam and Fraud Terminology

From A to Z, here’s a guide to the frequently used lingo of deception

)