AARP Eye Center

A Closer Look at the Medical Expense Deduction

By Gary Koenig, November 6, 2017 09:10 AM

The medical expense deduction is a tax benefit targeted to members of the middle class who have extraordinary medical expenses—that is, expenses exceeding 10 percent of their income. Many of the 8.8 million taxpayers who took the deduction in 2015 are dealing with chronic conditions and serious illnesses, like diabetes or Alzheimer’s disease, resulting in major financial stresses associated with treatment.

In 2015, the most recent year that national level data are available from the IRS, the income thresholds for itemizing medical expense deductions was 10 percent for taxpayers under age 65 and 7.5 percent for taxpayers age 65 and older. Roughly 55 percent of the 8.8 million taxpayers claiming the medical expense deduction in 2015 were age 65 and older and subject to the 7.5 percent income threshold. Today, that threshold is 10 percent of income for all ages.

While the tax bill eliminates the itemized deduction for medical expenses, it keeps a curtailed home mortgage interest (HMI) deduction and the deduction for charitable contributions. Comparing who uses these deductions shows that the medical expense deduction is much more targeted to the middle class than either the deduction for the HMI or charitable contributions.

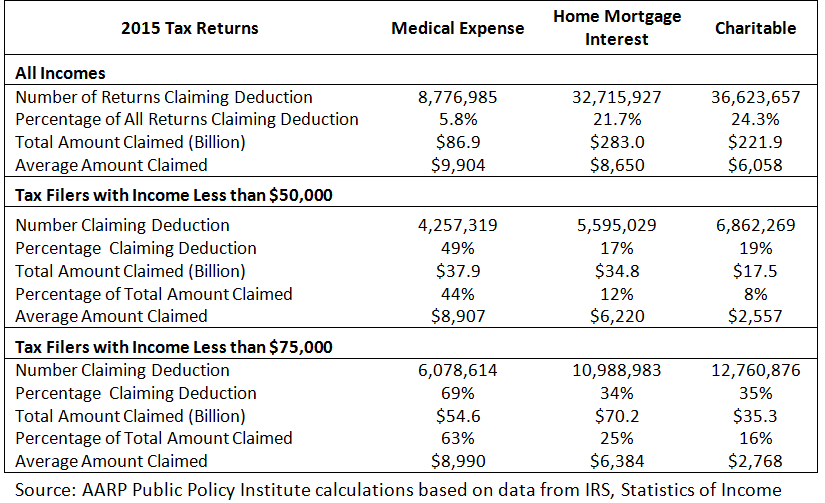

People who deduct medical expenses are much more likely to have lower incomes than those who take the HMI or charitable contributions deduction (Table 1). In 2015, nearly half (49 percent) of those who took the medical expense deduction had income less than $50,000, and nearly seven out of 10 (69 percent) had income less than $75,000. By comparison, less than one in five who took the HMI deduction (17 percent) or charitable contribution deduction (19 percent) had income less than $50,000. Further, for people with income less than $75,000, those figures rise to only 34 percent (HMI) and 35 percent (charitable).

Amounts deducted tell a similar story. Taxpayers with income less than $75,000 deducted an average of $8,990 in medical expenses. In addition, those in that income group deducted medical expenses of $54.6 billion, about 63 percent of the total amount deducted by all taxpayers ($86.9 billion). By comparison, the average amount deducted by those with less than $75,000 in income was $6,384 for HMI and $2,768 for charitable contributions. The total amount that income group deducted represented about 25 percent and 16 percent of HMI and charitable contributions deducted by all taxpayers, respective.

Table 1. A Comparison of Itemized Deductions for Medical Expense, Home Mortgage Interest, and Charitable Contributions