AARP Hearing Center

Beware of Financial Designations and Awards

By Allan Roth, July 8, 2015 03:15 PM

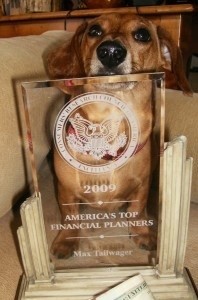

When you walk into my office, you may notice a beautiful granite and glass plaque gracing my bookcase that displays the honor of being one of “America’s Top Financial Planners.” It was awarded by the Consumers’ Research Council of America, whose address on Pennsylvania Avenue is less than a half mile from the White House.

Now before you think I’m just tooting my own horn, this impressive plaque is actually inscribed with the name “ Max Tailwager” — my beautiful and loyal dachshund. I purchased it to demonstrate to my clients and readers how easy it is to get these so-called prestigious awards. And it doesn’t stop there. Medical Economics magazine was willing to list Max as one of America’s Best Financial Planners for Doctors. I didn’t pony up the money to get that listing for my canine cutie, however. Getting more than one award would only go to his head.

Yet even I get fooled occasionally. Not too long ago, I received an email inviting me to appear on a Fox Business Network TV show for only $2,995 (normally $9,000). I had never considered that guests had paid to be on the show. When I called the producer who emailed me, he said there would be “small bumper print” at the beginning of the segment noting it was a paid spot. He said people tend to change the channel if they know it’s a paid spot. Duh!

Get the latest tips on protecting your money and saving for retirement — AARP Money newsletter »

The sad truth

We financial advisers want to win your trust, and the easiest way to do that is by showing you our awards and credentials. For example, there are now over 100 different financial designations. In fact, there are over 50 designations for professionals serving seniors. My particular favorite was the Certified Retirement Financial Advisor (CRFA). This group was willing to award me the designation after taking a course in Las Vegas; then, through a related organization, it would sell me leads to seniors looking for financial help. With one-stop shopping I could build credibility and then invite you to a free dinner seminar to sell you something that paid me a great commission – good for my retirement, but not so much for yours.

How to really find help

I’ve found that the best advisers don’t tout their accomplishments. In a recent speech at AARP headquarters, for instance, President Obama said that “there are a lot of very fine financial advisers who do the right thing for their clients.” He specifically cited Sheryl Garrett, founder of the Garrett Planning Network, yet I saw no mention of this on the Garrett home page. Though Sheryl Garrett and Max both received a shout-out from someone with a Pennsylvania Avenue address, one is a real residence while the other is merely a P.O. box. (I am not a member of this planning network.)

Getting good financial advice is a two-step process. First, check out any designation or award the adviser is using. Internet search engines make this process relatively simple, as you can see what people have written about the designation. You can Google “obtaining XYZ designation” to see how difficult or easy it is to get.

Get discounts on insurance and banking services with your AARP Member Advantages. »

Finding a qualified, smart adviser, however, is only the first step. Don’t ever buy into the argument that a “fee-only” adviser eliminates all conflicts of interests. Any time a dollar changes hands, conflicts arise. And since no one cares more about your money than you do, the second step is to make sure you fully understand both the strategy and every investment being made on your behalf. Simple strategies with transparent investments are typically superior. I recommend getting the adviser to write down the total costs you will be paying.

Photo: Allan Roth

Also of Interest

- Investing — It’s OK to Have Some Fun

- 10 Reasons to Get a Dog When You’re Over 50

- Get Involved: Learn How You Can Give Back

- Join AARP: Savings, resources and news for your well-being

See the AARP home page for deals, savings tips, trivia and more.