AARP Hearing Center

Gold Investing — Learning the Hard Way

By Allan Roth, August 3, 2015 05:00 PM

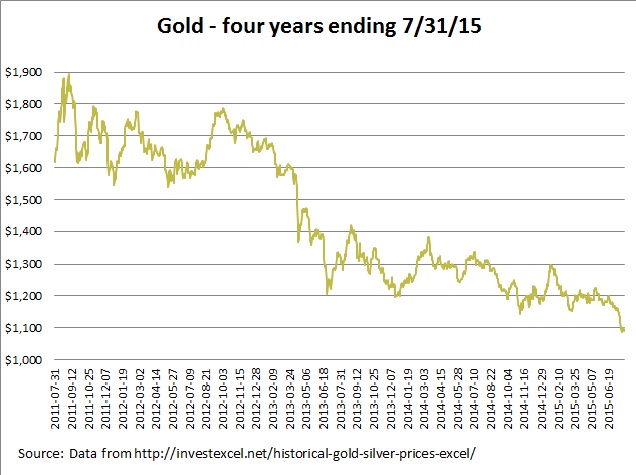

Gold is now down 43 percent since its peak in 2011. If you think that’s bad, gold-mining stocks are down more than 70 percent in the past five years.

As tends to happen, people have been dumping gold. Many owned gold in the form of an exchange traded fund (ETF) called SPDR Gold Shares ( GLD), which was the largest ETF on the planet back in 2011. As also tends to happen, investors bought the fund as it went up only to sell after the fall — which is, of course, perfectly irrational.

Get the latest tips on protecting your money and saving for retirement — AARP Money newsletter »

In a recent Wall Street Journal column , Jason Zweig noted that gold has fallen despite Greece defaulting, stress on the paper currency euro and the plunge of Chinese stocks. All of these events would seemingly be great news for gold, since it has typically been a safe haven during periods of instability.

Why people buy gold

Many people buy gold for the wrong reason. They think that paper currencies are under stress and gold is sure to go up. I know because I made this mistake during a much earlier gold rush. When I graduated from college, I took my graduation money and bought gold during a pullback in 1979 at $664 an ounce. With all the confidence and cluelessness of youth, I was sure that in a matter of months, it would be worth over $1,000, and there would be another digit to the value in a decade. In many ways, I now consider it my best investment ever because it taught me I wasn’t as smart as I thought I was. I’ve profited greatly from realizing I wasn’t smarter than the market.

What I said five years ago

Five years ago, as gold was about to peak, I sounded the warning:

- Gold cannot continue to increase at the pace it has over the past few years.

- We will not be going to the supermarket to buy our groceries with gold pieces.

- Gold has value only because we are drawn to shiny things, and we say it has value.

How low will it go?

When I wrote that piece five years ago, I had no idea that gold would fall as much as it has. And today I know that I don’t know the future of gold. But looking at history, two decades after my 1980 gold purchase, I had lost 60 percent of my investment in nominal dollars and far more after inflation. That could certainly happen again, though I think it’s unlikely. One thing that makes me feel like gold is closer to the bottom is that Jason Zweig’s column received fewer nasty comments from gold bugs. A sure sign of a bubble is that people will be intolerant of those questioning when the party will be over and the hangover will begin.

Get discounts on insurance and banking services with your AARP Member Advantages. »

Why own gold?

Gold can be a hedge against inflation. Since 1975, when it became legal for Americans to own gold, the metal has returned a real average of 0.8 percent annually (adjusted for inflation), according to Christophe Spaenjers, a finance professor at HEC Paris Business School. That’s less than stocks or even bonds. The real benefit of gold is that it can often zig when stocks zag. That’s known as having a low correlation with stocks and can smooth out a portfolio a bit. But remember that the total value of gold represents only about 1.3 percent of the total value of global financial assets.

So I agree with Jason Zweig that if gold represents more than 1.3 percent of your financial assets, you are making a bet on the shiny metal. If you bought gold over the past several years, you were probably performance-chasing. My advice is to maximize the value of your loss by learning from that mistake. If you are considering buying gold now, at least you know you aren’t performance-chasing. Buy it in moderation and make sure your holding period is at least a couple of decades.

Featured image: iStock/photo 345258

Also of Interest

- How to beat the S&P 500 index

- When to pay off your mortgage

- Ending hunger could be a SNAP

- Join AARP: Savings, resources and news for your well-being

See the AARP home page for deals, savings tips, trivia and more.