AARP Hearing Center

Where to Stash Your Cash This Spring

By Allan Roth, March 23, 2015 03:08 PM

If you want to make a hundred bucks or even thousands for just an hour of your time, then this post is for you. All you have to do is pick the right place to stash your cash and perhaps change your thinking on certain certificates of deposits (CDs). Read on, and you’ll see that CDs which appear too good to be true really do exist.

The power of inertia often has us leaving large sums of cash at our local bank or brokerage firm earning 0.01 percent annually, while some institutions are paying a hundred times this amount. Recent searches on DepositAccounts.com and BankRate.com reveal FDIC backed banks yielding as much as 1.10%.

That may not seem like a lot until you reframe your thinking. With a $10,000 deposit, that amounts to an extra $109 a year. If you have a hundred grand, that equals an extra $1,090. Clipping coupons is great, but these returns for your time are even better.

If you want more and don’t need the cash for a year, you can do much better. Here’s a CD that I found with some features that may seem too good to be true. It pays 1.13% for the first year and comes with two benefits:

- It gives you an option to earn 2.25% a year for up to four more years and you can decide to pull the money anytime during that period.

- It pays you a 1.12% bonus if you leave the money in the bank for the remaining four years.

This CD does exist. It's a five-year CD with a 180-day early withdrawal penalty either from Synchrony or Barclays Bank. The CD pays 2.25%, meaning you earn 1.13% after paying the penalty if you cash it in after a year. If you leave it in longer, you earn the 2.25% and, if you let it mature, you avoid paying the 1.12% early withdrawal penalty, which is like getting a bonus.

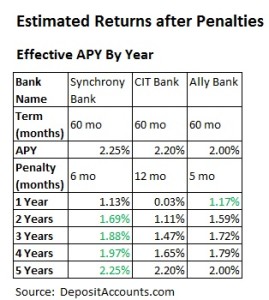

DepositAccounts.com has a nifty early withdrawal penalty calculator that illustrates what the returns would be based on the rates being paid, the penalty, and when the money is withdrawn. Though penalties vary by financial institution, here is a comparison of three banks with attractive rates and low penalties:

What rewards await you for getting that cash currently earning 0.01%, working harder? The extra 2.24% amounts to earning $224 annually on a $10,000 deposit, and $2,240 annually on a $100,000 deposit. That will buy you a $56 dinner every three months, or free gasoline for the next five years (based on driving 15,000 miles at 20 miles per gallon and $3.00 per gallon gasoline). Is that worth an hour of your time?

Other benefits

I’ve been using this CD strategy for well over a decade for yet another reason. If interest rates rise, the value of bonds and bond funds decline. But if, for example, rates rise by one percentage point in a year, I can make the decision to pay the 1.12% penalty in order to earn that extra one percent for four more years.

Get discounts on financial services with your AARP Member Advantages. »

By comparison, a really good bond fund like the iShares Aggregate Bond Fund (AGG) would lose an estimated 3.14% during that one year period. Also, the bond fund is yielding a bit less at 1.98% annually, and is only about 60% backed by the U.S. government. So, from an investment perspective, this CD strategy pays more with less risk. What’s not to love?

So fight inertia long enough to earn more. Always make sure your accounts are insured either by the FDIC or, for a credit union, the NCUA. Never go above the limits of $250,000 per depositor per institution although, if done right, you can get millions of dollars of insurance per bank by titling your accounts correctly.

Photo: AlexKalina/iStock

Also of Interest

- Are You a Saver or a Spender? Find Out Why

- 12 Foods That Sabotage Your Sleep

- AARP Foundation Tax-Aide: Get free help preparing and filing your taxes

- Join AARP: savings, resources and news for your well-being

See the AARP home page for deals, savings tips, trivia and more.