AARP Eye Center

Promoting Economic Security for Older Women of Color

By Nancy A. LeaMond, April 13, 2021 11:24 AM

This year, I’m committed to putting a spotlight on the challenges OLDER WOMEN face when it comes to achieving ECONOMIC SECURITY. The ability to enjoy a secure retirement begins long before a person turns 65 – that’s why it’s a multi-faceted, multigenerational problem. And while women’s outsized economic hurdles are just beginning to gain traction – especially in light of COVID’s impacts on jobs and caregiving – what doesn’t get nearly enough attention are the particularly acute economic struggles that older women of color face.

I recently had a (virtual) conversation with Tracey Gronniger, directing attorney for the economic security team at Justice in Aging, to shine a light on this important topic. Below are highlights from our conversation.

NANCY: Why do a significant portion of older women live near or in poverty?

TRACEY: I think that for so many women, the compounding effects of gender discrimination make it more difficult to make ends meet by retirement age. The gender wage gap means women are not making the same amount as men – and women are also overrepresented in low-wage jobs. That translates to not being able to save as much.

We also see the impacts of caregiving – which, despite being a critical need in our society, is not valued nearly enough and is completely unpaid labor for many. For the most part, it’s women taking time out of the workforce at various points in their lives to care for their children, their spouses, and their parents, which all chip away at their ability to save.

All these challenges culminate in lower Social Security benefits since it’s calculated by an outdated formula that only takes into account total wages and the amount of time a person worked. And on top of that, women tend to live longer. So, if an older woman’s spouse passes away, her income drops significantly – leaving her to live more years with less money.

N: What are some of the intersectional issues that make women of color even more likely to face economic insecurity as they age?

T: Older Black, Latina, and Native American women are living at twice the level of poverty as older white women. That’s because they have spent their lives facing the dual challenges of gender discrimination and systemic racial discrimination.

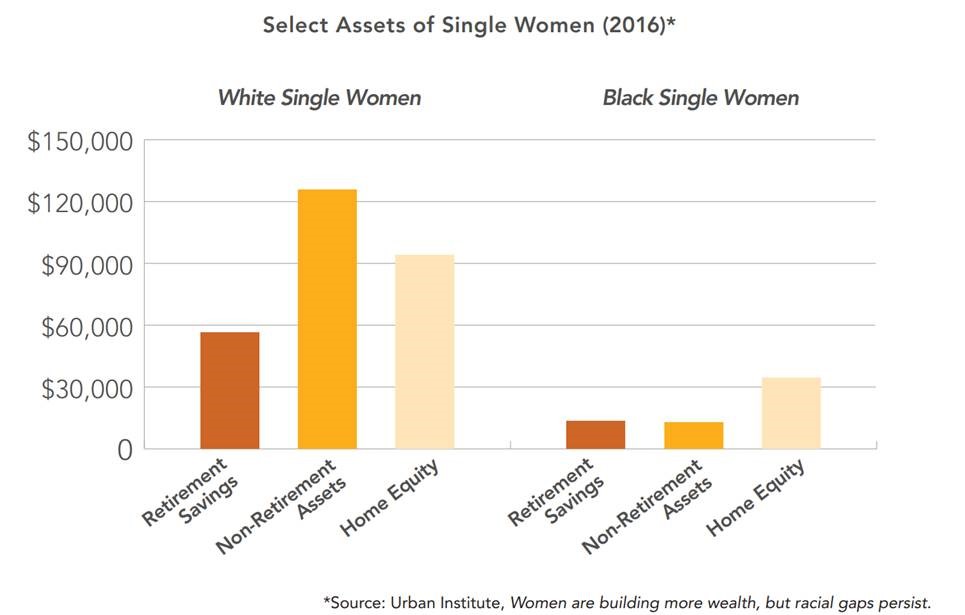

There’s the gender wage gap, which means less cumulative savings and therefore less Social Security retirement income to count on later in life. Additionally, for a lot of older Black women, the majority of their wealth is locked up in their home – and there are a lot of scams out there where predatory individuals and companies are looking to take equity away from them. And in communities of color, there is often a higher rate of grandparents raising grandchildren, which is an additional drain on one’s ability to save.

When you look at all these factors, you truly appreciate what we mean when we talk about the “intersectional” nature of the challenges so many older women of color face. And generally, once you appreciate the intersectionality of the issues that affect people, you realize that if you’re only looking at or addressing one dynamic, you’re probably not getting the whole picture, and therefore not providing adequate support to the people who are affected by multiple issues.

N: What can we do to improve the economic security of low-income women of color and their access to supports as they get older? If you could put a list together of the 2-3 most important things to focus on, what’s on it?

T: I think I would apportion my priorities in different stages of a woman’s life – because, as we’ve discussed, older women are experiencing the results of cumulative economic challenges over the course of their lives. So, I would focus on policies like paid leave and caregiver credits to balance circumstances taking place in women’s earlier to mid-life stages that have such a significant impact on their financial futures. We have to look at how we are not only keeping women from falling into poverty at these critical stages in life, but also how to make sure they have pathways for saving.

Another big piece I would look at is Social Security and Supplemental Security Income (SSI). Social Security is the biggest anti-poverty program in the US for older adults – but it’s insufficient. And SSI is an important program, but some pieces haven’t been updated in decades. For example, the asset limit to qualify for SSI is still just $2,000. How can you tell someone she needs to save and be ready for an emergency, but if she has $2,001, her SSI benefit is gone? That’s not supporting people or promoting the things we say are important. I think we have a big opportunity to really look at how we can modernize Social Security and SSI equitably in a way that will make the biggest difference for women of color who are utilizing these programs to avoid living in deep poverty.

And finally, I would focus on more affordable housing. At Justice in Aging, we’ve recently added housing as a major focus area. We just did a brief last month on the rental burden for older adults, and it’s really high. Low-income people are spending so much money to maintain housing, which means they’re more at risk of falling into homelessness – and people experiencing homelessness for the first time in their 50s is becoming a big issue.

****

Questions for Nancy or Tracey? Contact them at nleamond@aarp.org and tgronniger@justiceinaging.com.