AARP Eye Center

CLOSE ×

Search

Popular Searches

- right_container

- Health

- Money

- Work & Jobs

- Advocacy

- Social Security

- Medicare

- Caregiving

- Games

- Travel

- More...

- Entertainment & Style

- Family & Relationships

- Personal Tech

- Home & Living

- Auto

- Staying Sharp

- Podcasts

- Videos

A friend sent me the following article from the USA Today insert of his local paper. The article proclaimed “ The 60/40 stock-and-bond portfolio mix is dead in 2016” and went on to explain that with bond interest rates near historical lows, one should reach for higher returns by taking more risk…

Ever hear something like this and scratch your head wondering what it means?

Every couple of years or so, I evaluate college 529 plans. These are savings plans, usually sponsored by states, that allow us to put money away to help fund college for a child or grandchild. In fact, students are increasingly turning to grandparents to help pay for college. The plan you choose…

When should you begin taking Social Security benefits? That was a question asked of AARP.org visitors and registered website users . Less than 19 percent selected age 70, though that’s exactly what I tell the vast majority of my clients to do. Most object to my recommendation until I frame the…

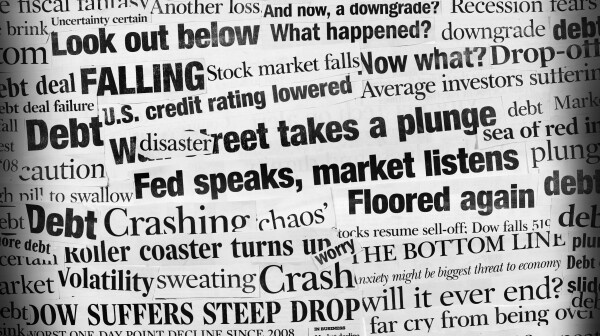

The headlines are brutal:

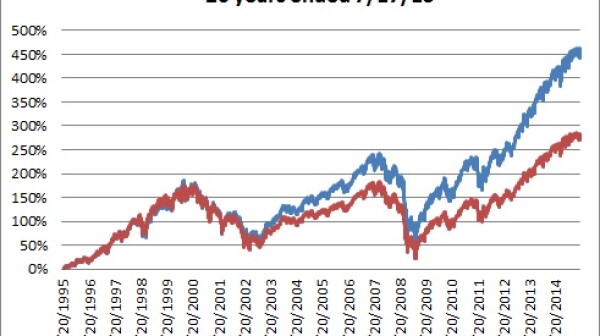

Most of us have heard that stocks have outperformed bonds in the long run. But what is the definition of long run? So far this century, have stocks really outperformed?

I’m often asked when the right time is to sell an investment. There are actually two answers — a logical one and an emotional one. Let me explain by illustrating through one of the lessons in a course I teach.

Gold is now down 43 percent since its peak in 2011. If you think that’s bad, gold-mining stocks are down more than 70 percent in the past five years.

I’m going to try to mislead you, but it’s for a very good reason. What I have for you is a U.S. stock fund that not only has beaten the S&P 500 index, it’s nearly certain to continue doing so in the long run. For now, I’m going to call this mutual fund the Super-Secret Fund, or SSF for short.

There have been many predictions of Armageddon throughout human history and, so far, all have been a bit exaggerated.