AARP Hearing Center

How to Beat the S&P 500 Index

By Allan Roth, July 29, 2015 12:41 PM

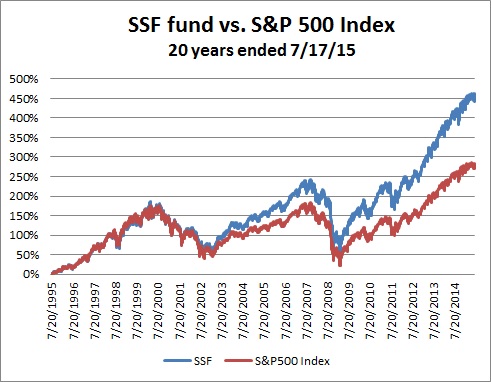

I’m going to try to mislead you, but it’s for a very good reason. What I have for you is a U.S. stock fund that not only has beaten the S&P 500 index, it’s nearly certain to continue doing so in the long run. For now, I’m going to call this mutual fund the Super-Secret Fund, or SSF for short.

Looking back over 20 years, you can see that the SSF trounced the S&P 500 index. Not only did it earn nearly twice the S&P 500’s return, but it met or exceeded the return during the entire period.

Get the latest tips on protecting your money and saving for retirement — AARP Money newsletter »

Admittedly, it takes about 25 years to prove skill over luck, as investors learned the hard way with Bill Miller’s Legg Mason Value Trust fund. That fund beat the S&P 500 for over 15 years before it crashed and burned, just after billions of dollars flowed into it.

SSF really is superior

What makes me so sure the SSF won’t suffer the same agonizing defeat as the Value Trust fund? It’s the investment technique used by SSF. This fund doesn’t use fundamental or technical analyses to pick winning stocks. So what is this wonderful SSF? Finally (drum roll), it is simply the Vanguard Total Stock Market Index Fund ( VTSMX), a market cap-weighted index fund of nearly every U.S.-based publicly held stock. And, unlike the S&P 500, this fund’s expenses have been deducted from its returns. I’ve been using the Vanguard Total Stock Market Index Fund for longer than the 20-year period shown in the chart above.

The comparison I made to the S&P 500 is trickery. However, there's good reason for my deceitfulness.

The first of two tricks I played was to compare the total return of the Vanguard index fund, with dividends reinvested, to the pure S&P 500 index, without dividends. See, when companies like Exxon and Apple pay dividends, those dividends aren’t counted in the S&P 500 index, but your broker is sure to count them in your return.

The second trick was to show the S&P 500, which is composed primarily of the largest 500 U.S.-based companies, against the Vanguard fund, which contains about 3,800 stocks, according to Chicago-based research company Morningstar. So the Vanguard fund contains midsize and small-cap companies, which have returned more than large-cap stocks on average over time as compensation for taking on more volatility.

The deception was in comparing the total return of the total stock market (represented by the Vanguard fund) to part of the return of part of the market (represented by the S&P 500 index without dividends). In simple terms, I compared apples to parts of oranges to make a misleading claim.

Why I tricked you

My point in tricking you was to show how such practices are part of the modus operandi of the investment business — and you should be forewarned.

I see charts and data comparing a portfolio’s total return (meaning dividends included) to raw indexes, with the manager claiming credit for outperformance. Market gurus on TV do this all the time.

Get discounts on insurance and banking services with your AARP Member Advantages. »

And the chosen benchmark may represent very different securities than those held in a portfolio. For instance, high-risk “distressed” bonds are sometimes compared with the Barclays Aggregate Bond Index of investment-grade securities, most of which are backed by the full faith and credit of the U.S. government.

As for equities, I have often called out advisers on the practice of comparing a very different group of stocks with the S&P 500, and I typically get a dirty stare as they tell me the S&P 500 is the expected benchmark.

So ask your adviser how your performance has been versus benchmarks. Ask how those benchmarks were selected and then confirm that the adviser is using the total return of that index, including dividend reinvestment.

Graph: Wealth Logic, LLC, data from Yahoo Finance

Also of Interest

- What the end of the world teaches us about investing

- When to pay off your mortgage

- Ending hunger could be a SNAP

- Join AARP: Savings, resources and news for your well-being

See the AARP home page for deals, savings tips, trivia and more.