AARP Hearing Center

The Disappearing Social Security Minimum Benefit

By Alison Shelton, October 16, 2014 12:04 PM

Social Security has a minimum benefit? Yes, it’s true. Congress designed the Social Security special minimum benefit in 1972 to help workers who have earned low wages for many years. But today, the benefit helps very few older Americans and unless Congress takes action, the benefit is on the road to extinction.

Sophia’s story is typical. She worked for 25 years as a clerk in a factory and doing odd jobs for wages that averaged about $9 per hour (about $18,000 a year). When she retired at age 66 last January, she was entitled to a yearly Social Security benefit of $9,794 — a benefit that falls beneath the federal poverty guideline of $11,670 for a single person.

Back in the 1970s or '80s, Sophia might have received a boost in her Social Security income from the special minimum benefit — but not these days. In fact few workers do: in 2010 only about 75,000 people were receiving the special minimum benefit — down from 200,000 in the early 1990s. The Social Security Administration (SSA) estimates that by 2018 it will no longer award any new benefits under the special minimum benefit provision.

The low and dwindling number of workers benefiting from the special minimum benefit reflects two program features.

First, SSA increases the initial special minimum benefit payment every year to match price inflation. In 2014, the largest possible special minimum benefit payment is $816 per month ($9,792 over the year) for workers with 30 or more years of work. Initial regular benefits, however, rise in line with wage growth, which historically has gone up faster than price inflation. As a result, almost everyone today receives a higher Social Security benefit under the regular calculation than under the special minimum calculation. This is certainly true for Sophia.

Second, it’s harder to establish eligibility, and earn credit, for the special minimum benefit than for regular retirement benefits. A worker needs more than 10 years of coverage to be eligible for the special minimum benefit calculation. And to get a year of coverage requires earnings to exceed $13,050. This is more than twice what a person must earn to gain credit toward regular Social Security benefits ( $1,200 for a quarter of coverage and $4,800 for a year of coverage in 2014).

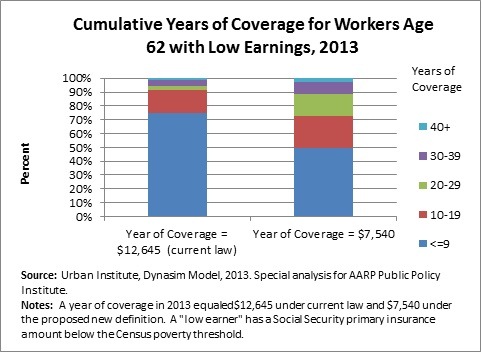

One way to increase the number of low earners who are helped by the special minimum benefit would be to lower the amount of earnings needed to earn a year of coverage toward the benefit. The Urban Institute compared years of coverage under the current earnings rule to an alternative threshold with earnings equal to 50 percent of the national full-time minimum wage (about $7,540 in 2013).The figure below shows the results for low earners, those with a Social Security benefit amount below the poverty threshold.

Only about one quarter of workers with low earnings have 10 or more years of coverage under current rules. Eligibility for the special minimum benefit would double, however, to about half of workers, if the earnings threshold were lowered to $7,540.

Congress could increase the number of workers helped by the special minimum benefit with a combination of indexing the benefit amount to wage growth and lowering the amount of earnings required to earn a year of coverage. Policymakers could also increase the full benefit amount or change the number of years of coverage required to earn a partial or full special minimum benefit. How these policy changes are combined would determine how many workers, and which groups of workers, are helped.