AARP Hearing Center

Can Indexing Become Too Big?

By Allan Roth, May 27, 2015 02:22 PM

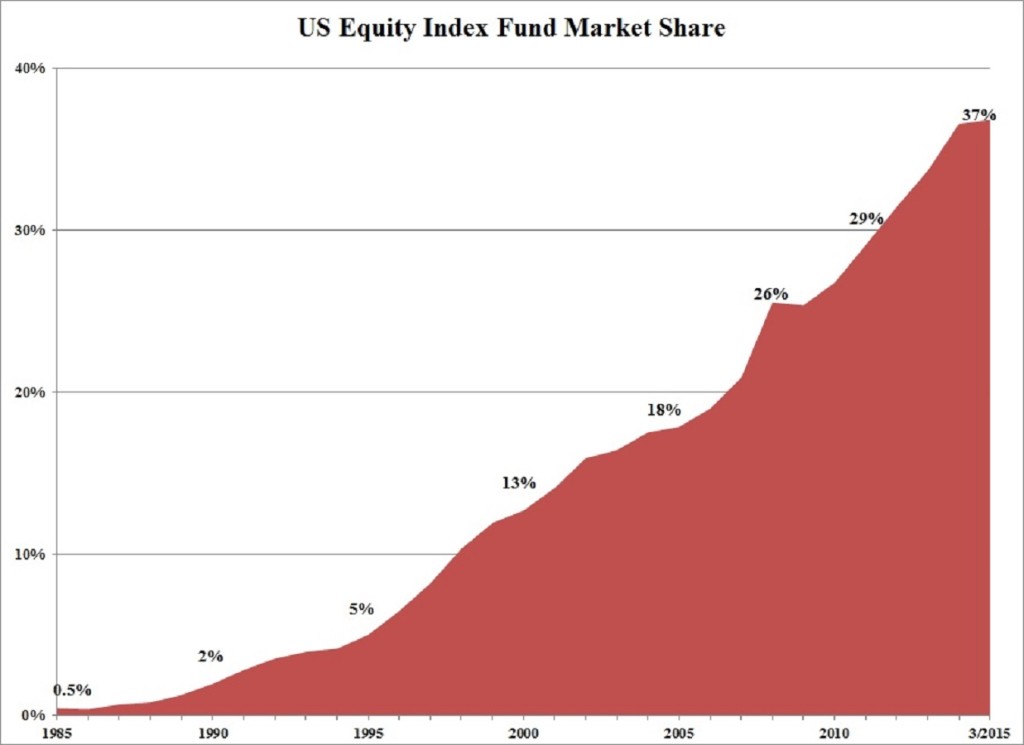

For some time now, actively managed mutual funds have been underperforming index funds that essentially own shares of all the stocks in the market. That’s because the lower costs of index funds give them huge advantages over the high-priced active funds. Though I’ve been investing in index funds for decades, I’m rather surprised by their more recent popularity. My indexing approach was once rare, but now a full 37 percent of the money in U.S. stock funds is in index funds. With more and more money flowing out of managed funds and into index funds, can indexing become too big?

Get the latest tips on protecting your money and saving for retirement — AARP Money newsletter »

Many people have come to me worried that indexing is, or will soon become, too big. They point to two reasons for concern. The first is that index funds now cause individual stocks to move together because the largest index funds own every stock. The second is that markets are becoming inefficient because fewer managers are working to determine whether stocks are over- or undervalued. Let’s examine each.

Indexing causes stocks to move together

This argument supposes there was a time when owning a couple of dozen stocks provided diversification, as some would move up while others would decline. These days, indexing has allegedly changed that since so much money is in funds that own every stock.

Rick Ferri, founder of Portfolio Solutions, points to the dispersion of stocks in the market. Dispersion tells us by how much the return of the average stock differs from the market average. Ferri notes that dispersion today is not significantly different than in the 1990s, when indexing had a tiny market share ( dispersion chart of the S&P 500).

And, logically, if an index fund rarely buys or sells stocks, it should have little impact on the price of any stock. Only new money coming in or being taken from index funds would cause buying or selling of every stock. Though true that indexing is capturing share, it still accounts for a tiny fraction of daily trading in stocks.

Get discounts on insurance and banking services with your AARP Member Advantages. »

Indexing causes markets to become inefficient

If everyone indexed, then no one would ever buy or sell a stock. Apple could come out with a great product and no one would drive the price up. Conversely, BP could have an oil rig disaster and no one would sell to drive the price down. Although this all may be true in theory, it’s not in reality. If it were the case, I would abandon my decades of indexing and become an active investor. How many active investors it takes to keep markets efficient is debatable. Certainly 10 percent of investors could drive stock prices based on market conditions. Financial theorist William Bernstein says, “I’m often asked how many active participants are necessary to maintain market efficiency: ‘Two dentists having lunch in Lubbock.’”

Active investor day

One thing I have changed over the last decade is trying to convince people that indexing is superior to active investing. Maybe it’s because deep down inside — and despite the arguments I just made — I am a bit concerned that indexing is becoming too large.

Today when someone tells me they are beating the market, I respond by congratulating them and telling them to keep doing what they are doing. In fact, I’ve even proposed a national holiday for active investors. Perhaps April 1 is a good day.

Chart: Bogle Financial Markets Research Center - Strategic Insight data; Featured image: wildpixel/iStock

Also of Interest

- Why You Need to Check Your Credit Report

- 11 Items with Hidden Costs

- Get Involved: Learn How You Can Give Back

- Join AARP: savings, resources and news for your well-being

See the AARP home page for deals, savings tips, trivia and more.