AARP Hearing Center

CLOSE ×

Search

Popular Searches

- right_container

- Health

- Money

- Work & Jobs

- Advocacy

- Social Security

- Medicare

- Caregiving

- Games

- Travel

- More...

- Entertainment & Style

- Family & Relationships

- Personal Tech

- Home & Living

- Auto

- Staying Sharp

- Podcasts

- Videos

One of the saddest messages I am most often required to deliver to new clients is that their bond income is merely an illusion, and a tricky one at that. In fact, in most cases, their actual income is a tiny fraction of the amount shown in their brokerage statement. If you own individual bonds (not…

Inflation lately has been pretty tame. Still, the possibility that it could raise its ugly head again, eating away at our spending power and standard of living, is always in the back of our minds. That’s why it’s important to understand inflation to better protect ourselves from its potential…

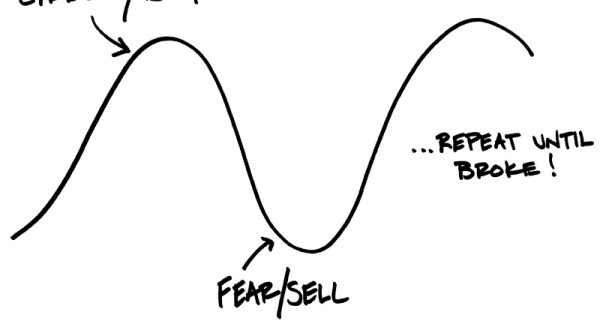

Too many of us are irrational investors. Acceptance of this fact and understanding the roots of our irrationality are the keys to better investing.

Many in the financial services industry will advise you not to pay down your mortgage. I can’t disagree more. Why? Because a mortgage is essentially the inverse of a bond:

Between mid-September and mid-October, the S&P 500 average sank nearly 150 points, or about 7.4 percent. Many investment pundits now suggest stocks are quite risky and the next great Bear Market could be coming. Suddenly bonds, previously shunned by many investment advisers, are looking more…

As we enter the home stretch of 2014, it’s time to consider some tax moves. Here are a few you might want to consider:

The headlines read “Stocks Plunge” and “Why the Selling Is Just Getting Started.” It’s enough to get anyone scared and ready to exit the market. Before you do, consider the following:

Most people define their net worth in dollars. As a financial planner, I define net worth in time. Allow me to explain.

When interest rates rise, the value of bonds declines. Many experts are sure that rates will increase next year, but should you worry about that? Why are experts convinced that rates will rise next year? For one, the Federal Reserve announced last week that it will start raising the federal funds…

Bloomberg News recently wrote about brokers profiting by advising retirees to roll their 401(k) accounts into IRAs. Many of the retirees interviewed said they lost a lot of their savings from investments subsequently recommended to them. But this doesn't mean you shouldn't consider transferring…