AARP Eye Center

Are You a Saver or a Spender? Find Out Why

By Allan Roth, March 17, 2015 02:02 PM

What makes one person focus on saving for his or her future, while another is totally oblivious and winds up hopelessly in debt? It turns out that our relationship with money is much more complex than we think.

Debunking conventional wisdom

In the 1996 best-selling book, The Millionaire Next Door , authors Thomas Stanley and William Danko revealed some little-known behaviors of the majority of millionaires. While millionaires, of course, were often high income earners, they were also hoarders who rejected the big-spending lifestyle. They tended to drive older cars, shop for bargains and not flout their wealth.

Get financial tips and tools in the AARP Money newsletter »

Conventional wisdom presumes that we learn our saving and spending habits from our parents and pass them down to our children. While this may sound intuitive, research suggests that presumption is not true. Thomas Stanley’s later research demonstrated that rather than emulating their parents’ financial restraint, children of millionaires are often spenders who can blow through a large inheritance.

What causes us to be savers or spenders?

The subject of why some run as fast as they can to keep up with the neighbors, and why others don’t, hasn’t been well explored in academia. Some research indicates that the cause comes down to the way our brains are wired. Here are two theories that explain some of these differences:

Theory 1: The pain of paying

A paper entitled “ Tightwads and Spendthrifts” addressed the issue of what makes some consumers more likely to buy things than others. Published in 2008 in the Journal of Consumer Research , the article theorized that the pain of paying drives tightwads to spend less than they would ideally like to spend. In contrast, spendthrifts don’t experience the same amount of pain and spend far more than they would like to spend.

The paper referred to some research in which participants were given a series of purchase decisions while having their brains scanned. It found that the purchase motivation was inversely related to activation in an area of the brain called the insula, a region that is commonly active when experiencing painful stimuli such as disgusting odors. The more the activity in the insula, the less likely the consumer was to make the purchase.

Theory 2: The joy of saving

The opposite of the pain one feels upon spending is the joy received from saving. The study found that the highly frugal tend to get joy from saving. This pleasure comes not only from not spending, but also from getting a good deal. Surprisingly, those who got the most pleasure from saving were not always those who experienced the most pain from spending. This suggests that some people spend conservatively for very different reasons.

Get discounts on financial services with your AARP Member Advantages. »

I spoke to behavioral economist Meir Statman, of Santa Clara University, on the joy of getting a good deal. Statman stated that a $70 steak will taste much better if the saver managed to get that steak for $7. But this is true only if the saver knows it’s a $70 steak. If we think it’s really a $7 steak, then it will not be perceived as tasting as good as a steak with a $70 price tag. Thus, savers will achieve the additional pleasure only if they believe they scored a better deal than the rate everyone else was paying.

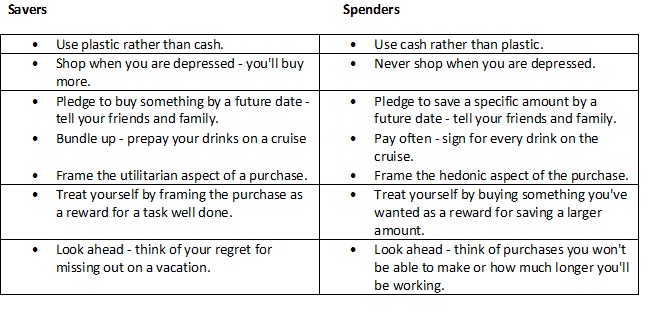

Can adult behavior be changed?

While it’s not easy to change someone’s behavior in adulthood, reframing the way we think about money can help. Here are a few suggestions.

Our relationships with money can be either healthy and constructive, or unhealthy and destructive. Neither excessive spending nor excessive saving is desired. What causes us to be spenders or savers is still not very well understood. Is it nature, nurture or, to some degree, just a random trait like other personality traits? There are many examples of families where one child is very outgoing and the other child is shy. The same may be true when it comes to building our nest egg.

99 Ways to Save on Everything »

Much more research is needed in this area. For now, there are practical lessons we can take from the data that exists. One is in the merits of teaching children delayed gratification at as early an age as possible, and another in the marginal behavior change that can be achieved with adults by reframing buying decisions.

Photo: GetUpStudi0/iStock

Also of Interest

- 6 Lessons From the 6-Year-Old Bull Market

- 13 Airport Navigation Tips

- AARP Foundation Tax-Aide: Get free help preparing and filing your taxes

- Join AARP: savings, resources and news for your well-being

See the AARP home page for deals, savings tips, trivia and more.