AARP Hearing Center

Is the Polar Vortex Worse Than Preparing Your Tax Return?

By Becky Gillan, March 2, 2015 12:09 PM

Why does the worst part of winter hit at the same time most Americans start preparing their taxes? Must be misery is better when it comes all at once.

The average 50-plus household makes about $50,000, so with no deductions that household will owe $6,100, or about 13 percent. In the United States, every paycheck until April 21, 2014, went to paying taxes. This day actually has a name: Tax Freedom Day, i.e., when the nation as a whole has earned enough money to pay its bill for all federal, state and local taxes.

Tax software from several well-known firms has at least made the process of filling out the forms easier — particularly if you purchase the same software year after year, as the program allows you to download the previous year’s data. If your income, sources and uses don’t change that much, this cuts the preparation time significantly.

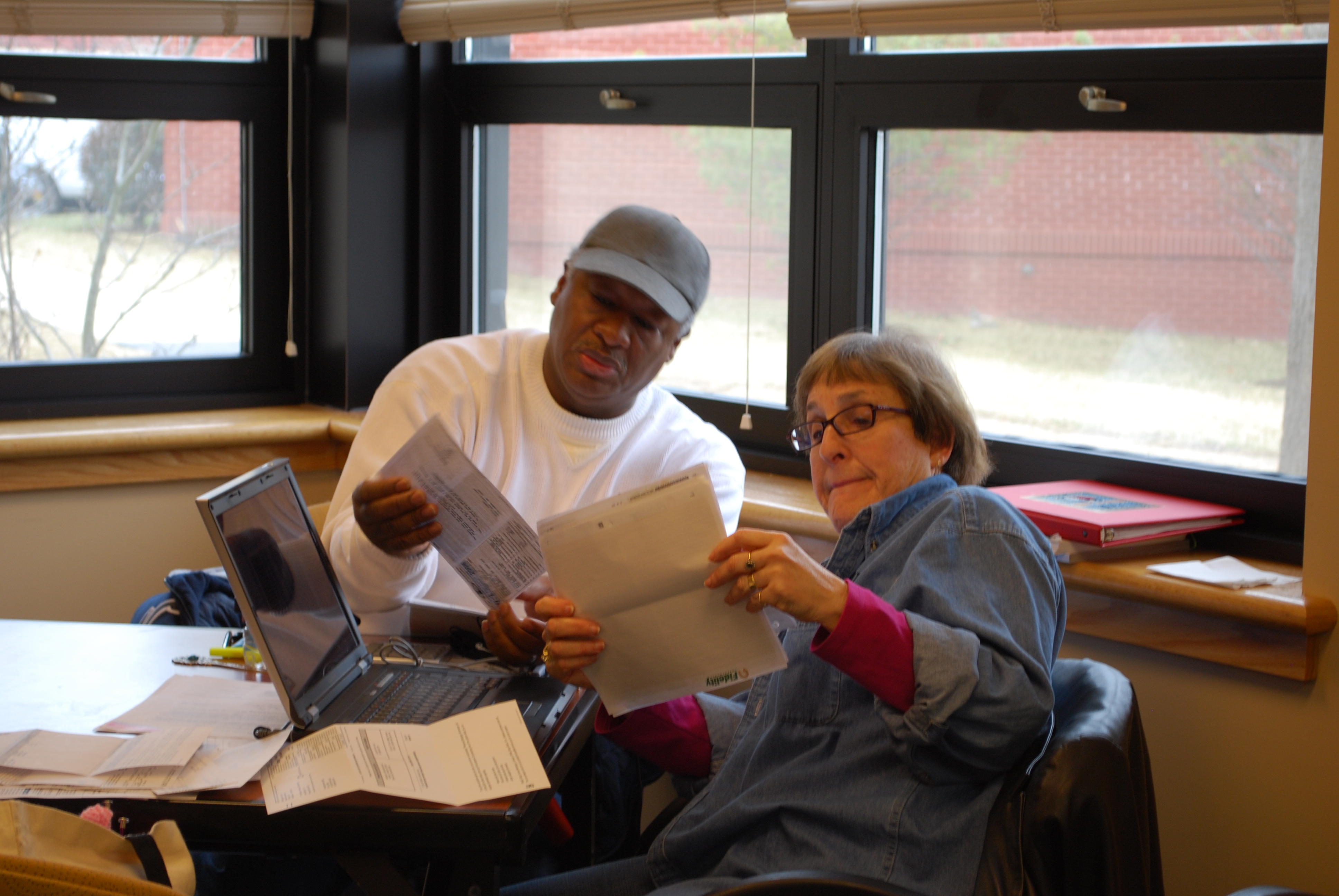

For folks daunted by even the thought of filling out forms, AARP has a best-in-class Tax-Aide service. AARP Foundation Tax-Aide is the nation’s largest free, volunteer-run tax assistance and preparation program.

Currently, more than 35,000 volunteers in all 50 states and the District of Columbia serve at more than 5,000 Tax-Aide sites from Feb. 1 to April 15. AARP Foundation Tax-Aide volunteers are trained and IRS-certified each year to ensure they know about and understand the latest changes and additions to the U.S. Tax Code.

In 2014, volunteers helped 2.6 million people navigate complicated tax codes, ensure proper credits and deductions, and electronically file their federal, state and local tax returns. Taxpayers who used AARP Foundation Tax-Aide received $1.4 billion in income tax refunds and more than $258 million in earned income tax credits (EITCs). They also avoided any tax preparation fees.

A gal I went to business school with has been an AARP Tax-Aide volunteer for over 20 years. She worked for a large accounting firm before starting a family and she has told me repeatedly that she relishes tax season and filling out the returns of her AARP clients.

AARP research shows that 52 percent of Americans age 50 and older have investments. Investment income or buying and selling investments can significantly complicate tax return preparation. It can mean filling out an “alphabet soup” of IRS schedules. This may be why 63 percent of people paid a commercial tax preparer in 2014.

Folks who go to a commercial tax preparer just do not want to even try to decipher how to complete all the forms. Others do it for peace of mind — believing the IRS will be less likely to scrutinize returns prepared by professionals. My dad felt this way, and I tried to tell him the IRS has algorithms that look at total income and deductions versus norms for others in the same income bracket. The IRS then decides which returns to audit. That explanation fell on deaf ears.

I have always prepared my own tax returns, and my former husband always had his done by the accounting firm that prepared the returns for his employer. That lasted one year after we were married. I casually looked at his return (the first year we were “married filing separately”) and found a $10,000 error (I’ve always been good with numbers). The firm acknowledged the error and asked for more money to prepare an amended return, even though the mistake was clearly theirs.

So, I cooked up a scheme. I really wanted a red coat at Saks and it was expensive, but only half the price the accounting firm wanted to prepare the amended return. Long story short: I got that coat. Every year after that, I chose a special something and that was my payment for my tax services. Maybe tax season isn’t all that bad! P.S. I have never been audited.

More from AARP Research:

Getting to Know Americans Age 50+: Fact Sheets

Use of Banking/Financial Products Among African-Americans/Blacks Age 50 & Over

Becky Gillan is the senior vice president of AARP Research and is focused on fostering understanding of the interests and concerns of people age 50-plus and their families. Before coming to AARP, she served as the vice president of Global Market Research & Guest Satisfaction for Starwood Hotels & Resorts. In her spare time, she likes visiting her niece in Ohio, gardening and collecting American art and antiques.