AARP Eye Center

How to Be Really Rich With Less Money

By Allan Roth, October 8, 2014 01:37 PM

Most people define their net worth in dollars. As a financial planner, I define net worth in time. Allow me to explain.

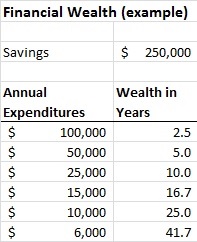

When I ask people to tell me what money means to them, I hear words like freedom, security and independence. Money, and having enough of it, allows us to do whatever it is that makes us happy. Reframing wealth as time turns some millionaires into paupers, and it makes those with $250,000 in 401(k) savings into the very wealthy. That’s because it defines wealth in the following way:

Wealth in years = net worth in dollars / annual expenditures.

Using this measure, someone worth $10 million, leading an extravagant lifestyle costing $2 million a year, has only five years of independence. The person worth $250,000, who needs only $10,000 a year to supplement Social Security, has 25 years of financial independence. This second person might never need to work again.

>> 10 Ways Bad Credit Makes Your Life Harder

We would naturally expect their portfolios to grow, yet so would their expenditures as inflation and taxes eat away at their gains. It may be reasonable to assume that the after-tax growth in their net worth might only keep up with inflation.

Considering the lifestyles of both, one might think that the person with the $10 million and extravagant lifestyle would be happier. Research demonstrates, however, that he or she may be only marginally happier. Sure, the big house and luxury car might bring short-term happiness, but it would be followed by the anxiety of running out of money to support that lifestyle.

How to build wealth

Implications of this measure for building wealth are enormous. The main ways to build wealth are to earn more or spend less, or doing both.

Earning more is always good, yet it actually has a far lower impact on years of financial freedom than spending less. That’s because earning more means giving some away in taxes, combined with the fact that you hopefully won’t work the rest of your life. On the other hand, spending less has a much greater impact, as the government doesn’t tax money you don't spend and we can spend less throughout our retirement.

As an example, let’s say that a 50-year-old can make $10,000 a year more and will retire in 15 years, which translates to $150,000. But if a third goes to taxes, he is left with only an additional $100,000. On the other hand, if he spends $10,000 a year less and has a 33-year life expectancy, that translates to $330,000 in savings.

In the above example, lowering annual expenditures by $10,000 had an approximately 3.3-fold benefit over earning $10,000 more. That means a dollar saved is worth far more than a dollar earned; in the example, it equaled approximately $3.30.

>> Get discounts on financial services with your AARP Member Advantages.

So how much money you need to live on is a far greater factor in determining your wealth, as measured by the freedom to do what makes you happy. Say you get to Social Security age and have saved $250,000. Depending on how much you need each year to live on to supplement your Social Security, your wealth could vary wildly from a couple of years to the rest of your life.

Spending less today has a doubling effect. It increases the amount of your savings and decreases the amount of the portfolio you will need to spend each year. Both will build wealth at an accelerated rate, and then you have the freedom to do what you want for the rest of your life. That’s what I call wealth.

Photo: DNY59/iStock

Also of Interest

- Will Interest Rates Rise Next Year? And Should You Care?

- 8 Germiest Places — Don't Touch That!

- Get Involved: Learn How You Can Give Back

- Join AARP: savings, resources and news for your well-being

See the AARP home page for deals, savings tips, trivia and more.