AARP Eye Center

Sounding the Alarm: The New Senate Health Care Bill Could Cut $3.2 Trillion from Medicaid by 2036

By Brendan Flinn, Lynda Flowers, Jean Accius, Ari Houser, September 19, 2017 05:08 PM

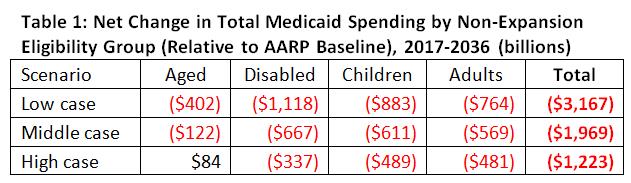

The latest Senate health reform bill, known as Graham-Cassidy-Heller-Johnson, puts Medicaid back on the chopping block. The proposal would change the way the federal government currently funds Medicaid by limiting federal funding and shifting cost over time to both states and Medicaid enrollees, and their families. New AARP Public Policy Institute projections find that the per enrollee cap proposal in Graham-Cassidy-Heller-Johnson will cut between $1.2 trillion and $3.2 trillion from total (federal and state) Medicaid spending over the 20-year period between 2017 and 2036 (see table 1 below).

How Graham-Cassidy-Heller-Johnson Cuts Medicaid

The Graham-Cassidy-Heller-Johnson bill has many of the same harmful provisions that were in the Better Care Reconciliation Act that the U.S. Senate rejected this past summer. For example, beginning in 2020, the bill would subject the traditional Medicaid eligibility groups- aged, disabled, and children [1] to mandatory caps on a per-person basis. States would have the option to choose between block grants and per capita caps for adults without disabilities. [2]

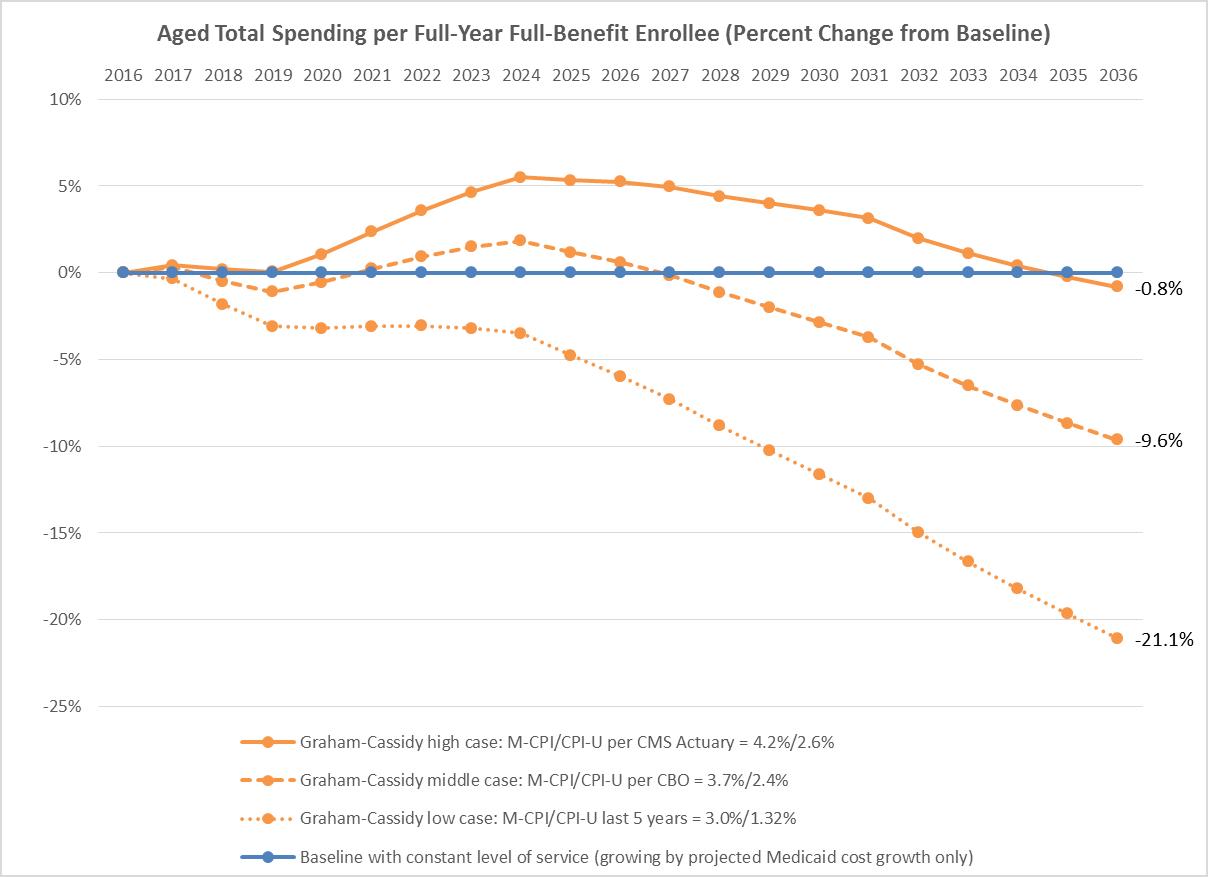

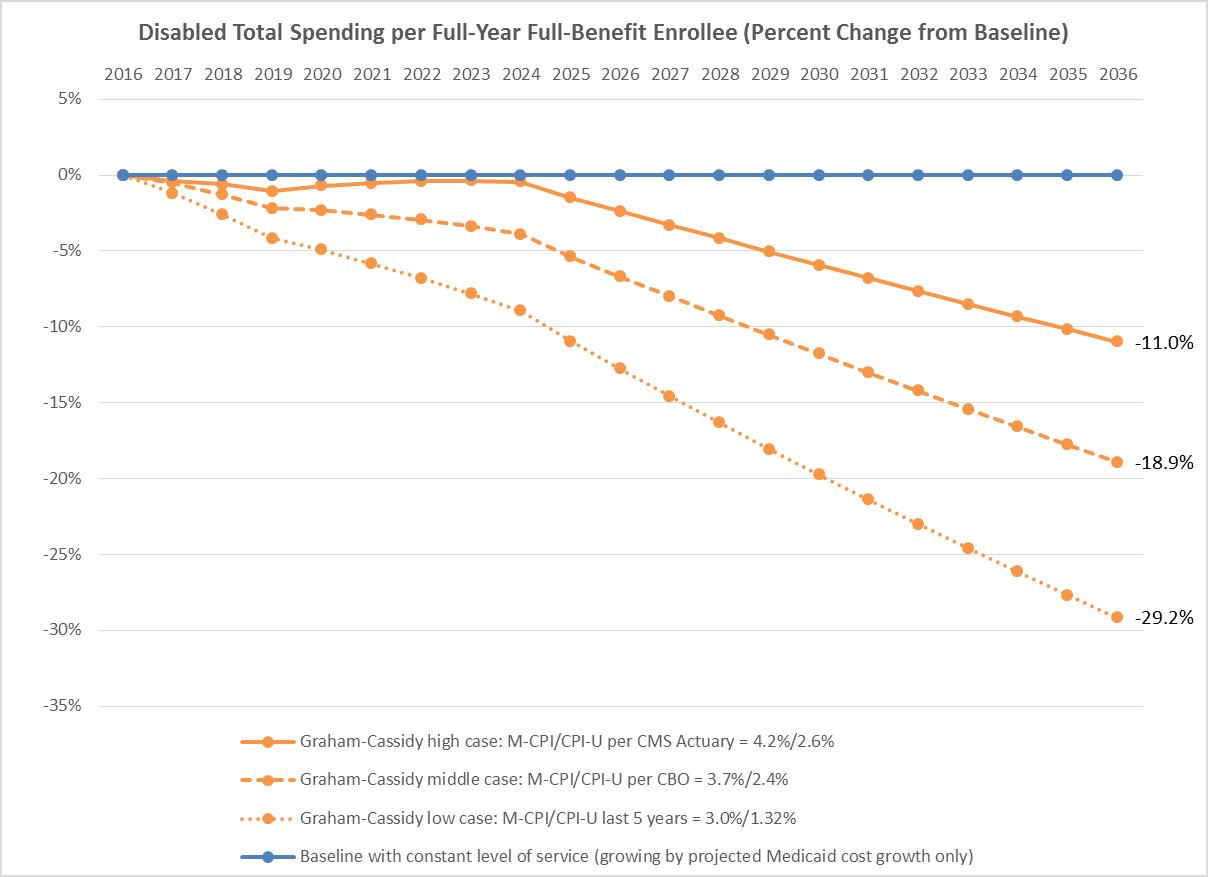

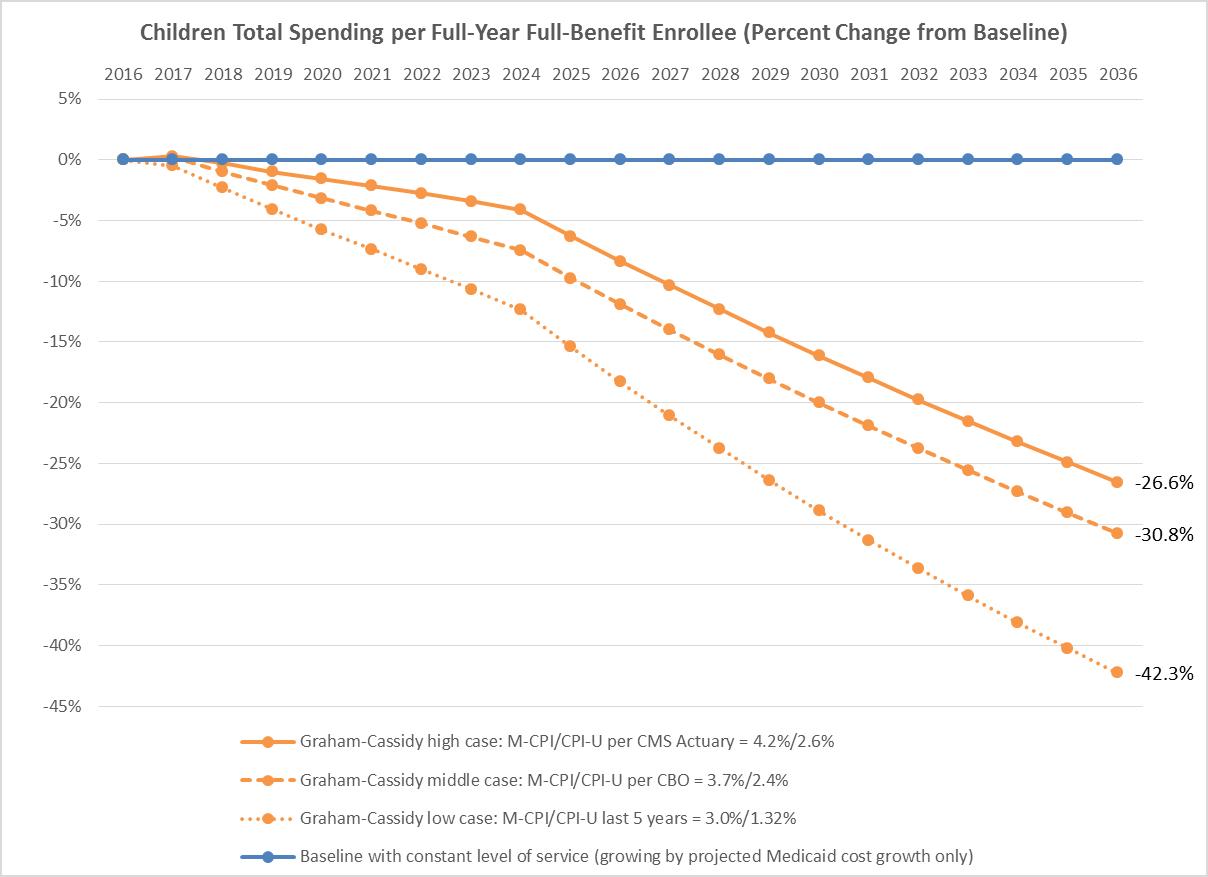

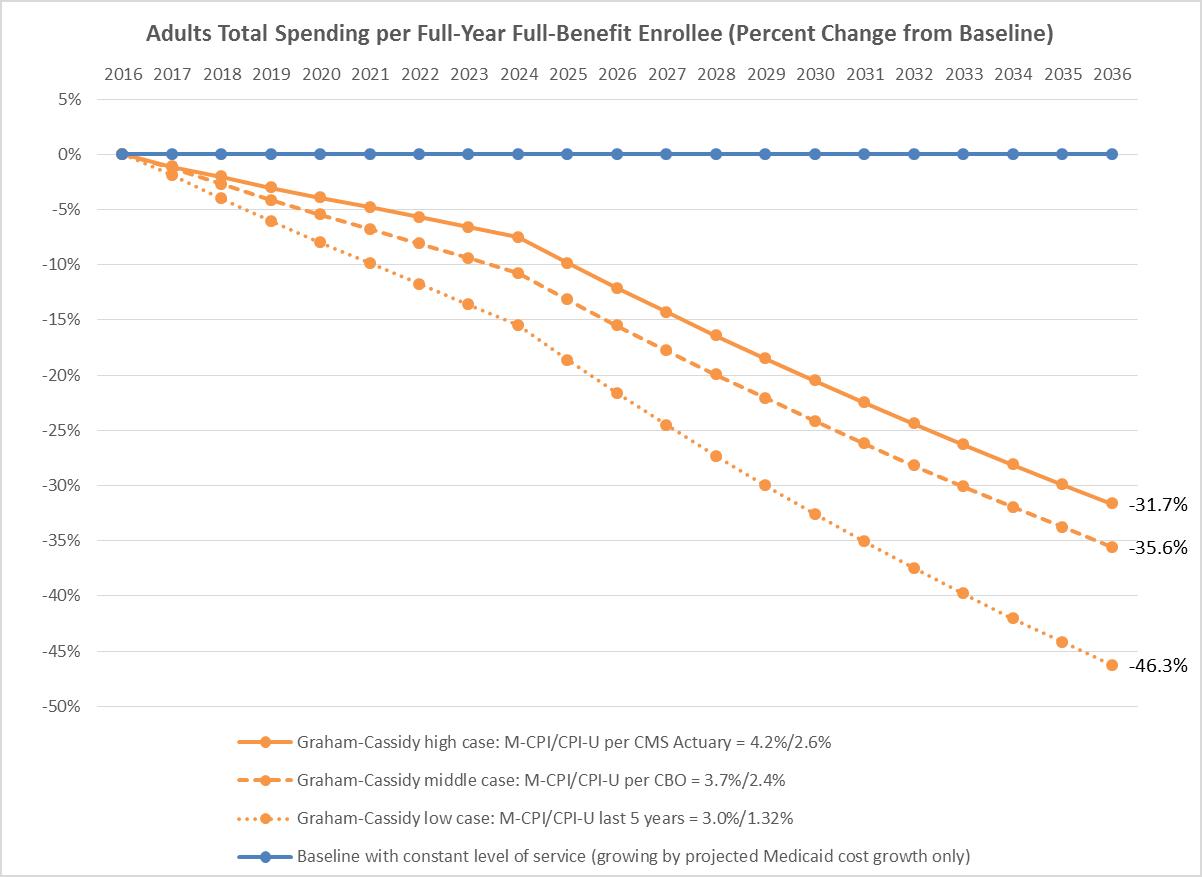

The Graham-Cassidy-Heller-Johnson bill would start out using the medical care component of the Consumer Price Index (M-CPI)—a measure of the average out-of-pocket cost of medical care services used by an average consumer—as the growth rate for adults and children. It would use M-CPI plus one percentage point (M-CPI+1) for older adults and individuals with disabilities. However, beginning in 2025, it would slash the growth rate for adults and children to the Consumer Price Index for all urban consumers (CPI-U)—a measure of general inflation that examines out-of-pocket household spending on goods and services used for everyday living. CPI-U does not tie closely to medical costs and will not reflect population growth. For the older adults and individuals with disabilities, the growth rate would decrease to M-CPI starting in 2025.

To be clear, none of the proposed growth factors—M-CPI, M-CPI+1, and CPI-U— keep pace with the growth in Medicaid spending. The proposed Medicaid cuts will grow deeper over time.

AARP Public Policy Institute’s Projections

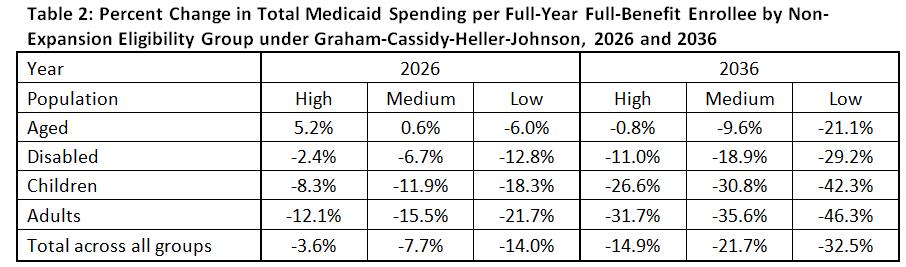

The Graham-Cassidy-Heller-Johnson bill ties the growth rates for per enrollee caps to M-CPI and CPI-U, and these growth rates are variable and highly uncertain. The AARP Public Policy Institute models this uncertainty by highlighting three scenarios for M-CPI and CPI-U, based on reasonable projections (see tables 1 and 2 below for full details).

We present the high, middle, and low case for M-CPI/CPI-U growth rates based on the following:

- Low Case. Based on historical growth rates. Over the last five years (2012-2016), the M-CPI growth rate has averaged 3.0 percent per year, and the CPI-U growth rate has averaged 1.32 percent per year.

- Middle Case. Based on projections from the Congressional Budget Office. CBO projects M-CPI to grow by 3.7 percent per year, and CPI-U by 2.4 percent per year.

- High Case. Based on projections from 2016 Centers for Medicare and Medicaid Services Medicaid Actuarial Report. From 2019 onward, this report projects M-CPI to grow by 4.2 percent per year, and CPI-U by 2.6 percent per year.

The AARP Public Policy Institute projects that by choosing per capita cap growth factors that are lower than projected Medicaid cost growth and dramatically reducing these rates beginning in 2025, Graham-Cassidy-Heller-Johnson would cut $1.2 trillion to $3.2 trillion from total (federal and state) Medicaid spending, including up to $402 billion in Medicaid cuts for older adults.

These cuts could be as much as 14 percent of total Medicaid spending in 2026 and 33 percent in 2036 across all populations. For older adults, per enrollee cuts could be as high as 6 percent in 2026 and 21 percent in 2036 (see Table 2 below). The projections do not include the proposed cuts to the adult Medicaid expansion population, which would also be considerable for those states that expanded coverage.

New graphs from the AARP Public Policy Institute illustrate Graham-Cassidy-Heller-Johnson’s proposed cuts to Medicaid and show that for all affected populations—older adults, adults with disabilities, children, and non-expansion adults—the proposed cuts to Medicaid are, in fact, a cut—and one that will hurt.

These significant cuts to Medicaid will have negative impacts on older adults, adults with disabilities, and individuals and families who rely on Medicaid to meet their health care and long-term services and supports needs. Limiting the amount of federal dollars will force states to make some difficult choices—like cutting benefits or further limiting provider reimbursements. The result is clear: access to services for some of the most vulnerable populations in our society, guaranteed for over a half-century, would be in jeopardy.

[1] Children with disabilities are not subject to the caps.

[2] Medicaid expansion adults are dealt with separately in the bill and are not referenced in this report.

Jean Accius is vice president of livable communities and long-term services and supports for the AARP Public Policy Institute. He works on Medicaid and long-term care issues.