AARP Hearing Center

Reframing the Social Security Decision

By Allan Roth, September 2, 2015 12:08 PM

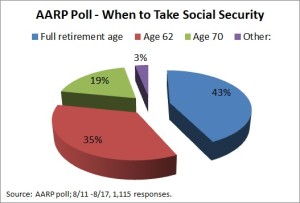

When should you begin taking Social Security benefits? That was a question asked of AARP.org visitors and registered website users . Less than 19 percent selected age 70, though that’s exactly what I tell the vast majority of my clients to do. Most object to my recommendation until I frame the decision in a different way, which is that they can spend money now and still let it grow.

Take this recent case, for example. Kate is 66 and is eligible to receive her $26,244 annual Social Security benefit now or may collect 32 percent more if she waits another four years. If inflation averages 2 percent annually (the Federal Reserve’s target), then Kate will be giving up $108,167 by waiting, and that’s a lot of money. But by waiting, she will be getting an additional $9,090 in benefits annually beginning at 70, and that will increase with inflation.

Kate is reluctant to wait and wants to enjoy the money now, even though she is in good health. I tell her to think about it differently in that she can do both. This is what I call reframing the decision.

Get the latest tips on protecting your money and saving for retirement — AARP Money newsletter »

While technically she would be waiting, my advice is to take the current funds from her investment portfolio to live on and have some fun. What she would effectively be doing, I argue, is buying what’s called an inflation-adjusted deferred-income annuity. That’s where you hand the insurance company a chunk of money and it promises to pay you an amount for the rest of your life beginning on a certain date, which is four years in this case. It gives money for life and lowers the probability you will run out of it if you live a long time, which is known as longevity insurance. Only in this case, the Social Security Administration is the insurance company.

Not only is Kate effectively buying this annuity, but she’s also buying it at a bargain price. I investigated such an inflation-adjusted deferred-income annuity paying $9,090 annually, increasing with inflation, and the best price I could find from the highest-rated insurance company was $162,825. So giving up $108,167 was actually buying the income at a discount of nearly 34 percent.

Mike Piper, author of Social Security Made Simple (Simple Subjects LLC, 2012), says the deal is even better for married couples. Let’s say Kate is married to Jim, who is the same age and has no Social Security benefit of his own. If Kate passes away before Jim, Jim would be entitled to a Social Security survivor benefit that is the same as Kate’s benefit. Thus, he would continue to get the additional $9,090, increasing each year with inflation. To purchase that same survivor benefit in the open market would cost $186,776, I found. Deferring Social Security is then like buying this deferred-income annuity at a 42 percent discount. Most scenarios I look at come out within this 34 percent to 42 percent discount.

Applying this to your decision

Two things to take into account are, first, you must have an investment portfolio you can live on in the meantime or must be able to continue working. If you need the Social Security to live on before 70, don’t even consider this option. Second, you must be in reasonably good health and either you or your spouse must have an average or greater life expectancy. Statistically speaking, this is likely to be true. According to research from the Brookings Institution, the richer you are, the longer your life expectancy. So if you can afford to delay Social Security, you probably have a longer than average life expectancy. Also, if you are reading an AARP money blog, you probably have a greater than average amount of wealth.

Get discounts on insurance and banking services with your AARP Member Advantages. »

Have your cake and eat it, too

So if you can wait until 70, you can enjoy your money now by spending down your portfolio at a faster rate while deferring Social Security, which is like buying a deferred-income annuity at a bargain price. What’s more, you will have lowered the probability you will run out of money.

This strategy is also validated by academic research by the Stanford Center on Longevity. Recent papers support delaying Social Security benefits, and coauthor Steve Vernon told me their work “confirms the desirability of the strategy to use retirement savings to delay starting Social Security [benefits].”

There you have it. This reframing of the question is how I get many of my clients to delay Social Security benefits, and it’s something you should consider as well.

Featured image: Skhoward/iStock

Also of Interest

- The stock market plunge: What you should do, or not do

- 2016 Social Security COLA? Don’t bet on it

- Help bring relief to struggling seniors; find volunteer opportunities near you

- Join AARP: Savings, resources and news for your well-being

See the AARP home page for deals, savings tips, trivia and more.