AARP Hearing Center

CLOSE ×

Search

Popular Searches

- right_container

- Health

- Money

- Work & Jobs

- Advocacy

- Social Security

- Medicare

- Caregiving

- Games

- Travel

- More...

- Entertainment & Style

- Family & Relationships

- Personal Tech

- Home & Living

- Auto

- Staying Sharp

- Podcasts

- Videos

More than 1,000 people struggling with credit-card debt turned to a debt-settlement company for help. Instead of using the consumers' $2.2 million in fees to pay their creditors, the company's owner and employees purchased luxury car leases and other goods, according to a federal indictment…

OK, so maybe I'm a little biased. But a new survey finds what we mothers have known all along: We're better than dads when it comes to discussing money matters with our adult kids.

Our parents may have moved to a warmer climate, traveled around the globe or retreated to the porch rocking chair in retirement. But boomers' ideas about how they plan to spend their retirement years don't seem nearly as relaxing or leisurely.

We patients tend to be stubbornly loyal to our trusted physicians. We respect their experience and seek their advice.

UPDATE: Last week, we cited a report by The New York Times that a growing number of older adults are using their pensions as the basis to borrow cash -- and paying interest rates as high as 106 percent.

In this economic climate of relatively low interest rates, who pays 322 percent in annual interest for short-term loans? Consumers who repeatedly take on payday loans.

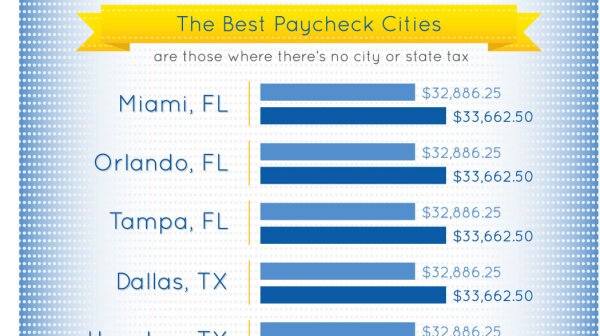

Two reports are out on home ownership and how far paychecks go in certain cities. They're not related, except that you need a paycheck to buy a home, generally, but I found the research interesting.

As we head into our retirement years, we could all use a little financial guidance to help us fluff up our nest eggs. Do we tap a certified senior adviser or chartered financial consultant for advice, or would a senior or retirement specialist be better? Maybe a certified trust and financial…

UPDATED: Some of us may dread tax day, April 15, but it's also a day to cash in on some freebies.

About to change jobs? If you have a 401(k) account, you're at risk of getting bad information when you ask the company managing your retirement plan about your options.