AARP Hearing Center

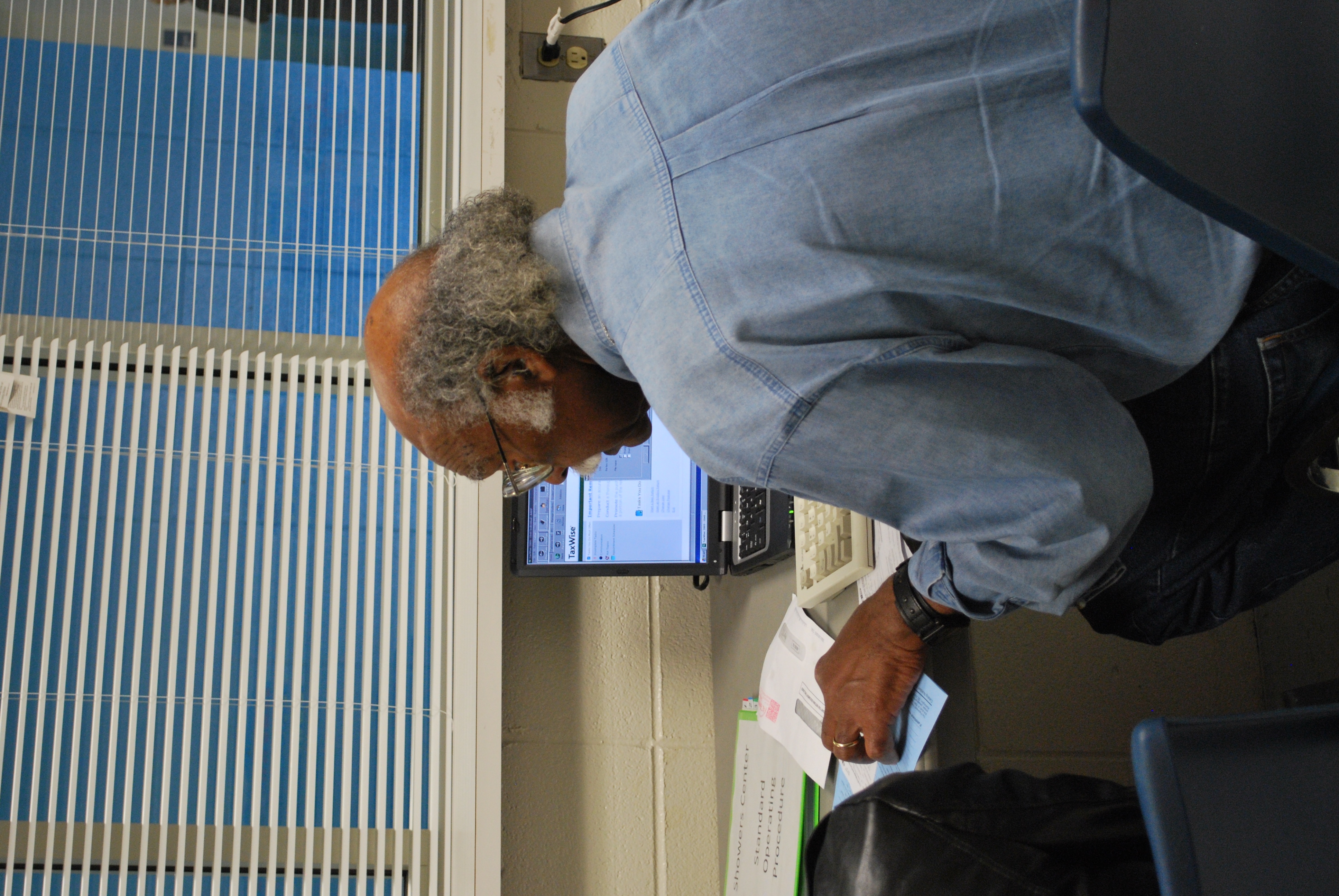

10 Weeks of Service: The Life of a Tax-Aide Volunteer

By Jen Martin, April 3, 2012 12:36 PM

This is a guest post by Jo Ann Jenkins. Jenkins is the president of AARP Foundation. She provides leadership across the Foundation areas of development, litigation, and impact program areas.

HELP WANTED: Looking for someone to prepare individual state and federal tax returns. At least one week of training--and homework -- required, along with passing three progressively difficult IRS test levels plus an IRS ethics test and any state-required exams. Must be flexible yet willing to work up to 40+ hours a week, up to six days a week, for 2-1/2 months. Must have strong analytical skills, ability to handle pressure in a fast-paced environment, excellent customer service and communications skills, extraordinary attention to detail and be a team player. Salary: None, but both transportation reimbursement and the joy of helping others provided.

Believe it or not, every year AARP Foundation Tax-Aide signs up at least 35,000 volunteers who meet this job's requirements. Eighty percent are return volunteers -who average 7 years serving taxpayers - and 20 percent are first-timers. Because not everyone is able to commit to the training, time and responsibility in this unique volunteer position, most of the attrition takes place in the first or second year of volunteering. Those who remain consistently rate their satisfaction and the impact of their work highest among the AARP and AARP Foundation volunteer corps. For example,

- Almost three out of four are 60 or older;

- Two-thirds are women; and

- Household incomes aren't high: The average income of all returns e-filed is $23,000

- Clearly AARP Foundation Tax-Aide volunteers are assisting those who really can use this free service.

AARP Foundation Tax-Aide volunteers share a common trait: a deep sense of personal responsibility. However, often times, consistently sitting across the table from someone who has entrusted you with their taxes - and all of the personal knowledge that entails - often comes with challenges. There may be language barriers or, more often, tax comprehension barriers. The taxpayers who get their taxes prepared by AARP Foundation Tax-Aide are mostly the people our program is designed to serve - older low-to-moderate income taxpayers. If volunteers don't come equipped with innate diplomacy and tact, along with the ability to explain complex tax regulations in simple terms, they quickly develop these skills. Working effectively as a team is also important, because another volunteer is required to check every tax return before it is filed.

Being able to tell the taxpayers they're getting a larger refund or tax credit than they anticipated makes every volunteer happy. "It's like Christmas every day around here," says Peggy Jackson, who manages an AARP Foundation Tax-Aide site in Huntsville, Alabama.

Many volunteers report even though they'd known there would be a void to fill once they stopped working, they hadn't realized how much they would miss both the workplace camaraderie and the daily opportunity to use their hard-earned skills. Lucette Kaplan, of Queens, NY, is a prime example. She retired in 2006 after a long career in the import-export business. A few months later, she says, "I was going crazy, trying to find out if there's life after retirement." She answered a newspaper ad for Tax-Aide volunteers, and she's been with the program ever since.

But being an AARP Foundation Tax-Aide volunteer is more than finding a new life, as Lucette would be the first to agree. Year after year, AARP Foundation Tax-Aide volunteer surveys show that at least 95% say the most important part of their volunteering is the satisfaction they get from helping others. There's only one tax group that registers the same level of satisfaction, and that's the 2.5 million taxpayers the Tax-Aide volunteers serve every year: 95% of them are very satisfied with the service they receive.

Congratulations and thank you to the 35,000+ AARP Foundation Tax-Aide volunteers who will be finishing up their 10 weeks of service on April 17, and to the 20% of them who hold leadership positions and work many more months. You make us very proud.

For more information on the Tax-Aide Program go HERE.

Photo credit: Mara Kaiser