AARP Hearing Center

Congressional Budget Experts Predict More Red Ink

By Tamara Lytle, September 19, 2013 09:41 AM

The nonpartisan Congressional Budget Office has just published its 2013 Long-Term Budget Outlook, and this year's set of predictions for the nation's balance sheet is sure to push Washington's heartburn rate up a few notches.

Three quick takeaways from the CBO's report:

The percentage of federal debt held by the public is higher than at any point in modern U.S. history. Federal debt held by the public is likely to decline a little bit over the next few years, as a percentage of the economy, but then watch out. The CBO projects that, under current laws governing taxes and spending, federal debt will climb even higher than it is now (73 percent of gross domestic product) and keep going, up to 100 percent of GDP in 2038 - a level the country can't sustain. And that's without even accounting for the harmful effects that the growing debt would have on the economy.

Deficits are headed up, too. The federal budget deficit is the smallest it's been since 2009, but the CBO says that, after continuing to drop over the next few years (again, assuming that current laws governing tax and spending generally remain in place), budget deficits will gradually rise again. Why? The CBO offers several reasons, including higher interest costs, the pressures of an aging population, rising health care costs and an expansion of federal subsidies for health insurance.

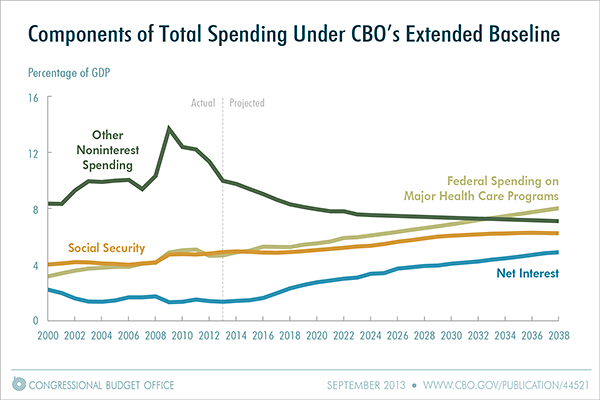

As a percentage of the economy, federal spending for major health care programs and Social Security will double by 2038. Without significant changes in current laws, the CBO projects that, over the next 25 years, federal spending for the major health care programs and Social Security will increase to a total of 14 percent of GDP. As the following CBO chart shows, spending on health care programs is the main driver of this projected increase:

Also of Interest

- Computer-Operated Car Takes Congressman for a Ride

- Wacky Retirement-Related Words You Won't Find in Webster's

- Questions about the health law? Get your answers here.

- Join AARP: Savings, resources and news for your well-being

See the AARP home page for deals, savings tips, trivia and more