AARP Hearing Center

Medicare Part D Spending on Drugs Selected for Price Negotiation Exceeded $180 Billion between 2017 and 2023

By Leigh Purvis, August 29, 2023 01:17 PM

Twenty years ago, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA) created the Medicare Part D prescription drug benefit to cover prescription drugs that were purchased at retail pharmacies. Today, more than 50 million Medicare beneficiaries are enrolled in the program.

While Medicare Part D enrollees report high satisfaction with the program itself, many are still burdened by high drug prices and related out-of-pocket costs, and there are longstanding concerns about a provision in MMA that explicitly prohibited Medicare from negotiating drug prices on behalf of its tens of millions of enrollees. However, these concerns began to be addressed when Congress passed the Inflation Reduction Act in 2022 that—among many other provisions designed to address high prescription drug prices and costs—will now allow Medicare to negotiate the prices of certain high-cost prescription drugs.

Medicare just announced the first set of Part D drugs that will be subject to negotiation, and the resulting negotiated prices will become available in 2026. Additional sets of drugs will be selected every year, and Medicare Part B drugs will be added to the negotiation process in two years.

The drug industry has strongly criticized Medicare negotiation and filed multiple legal challenges to prevent it from proceeding. They have also argued that allowing Medicare to negotiate drug prices will stifle research and innovation.

However, the reward for developing meaningful new prescription drugs remains high. Based on Medicare Part D spending alone—which does not include revenue from all other US and non-US consumers—the selected drugs have recouped the average cost to develop a new drug several times over between January 2017 and May 2023.

Medicare Part D Spending on Selected Drugs Exceeds $180 Billion Over 6 Years

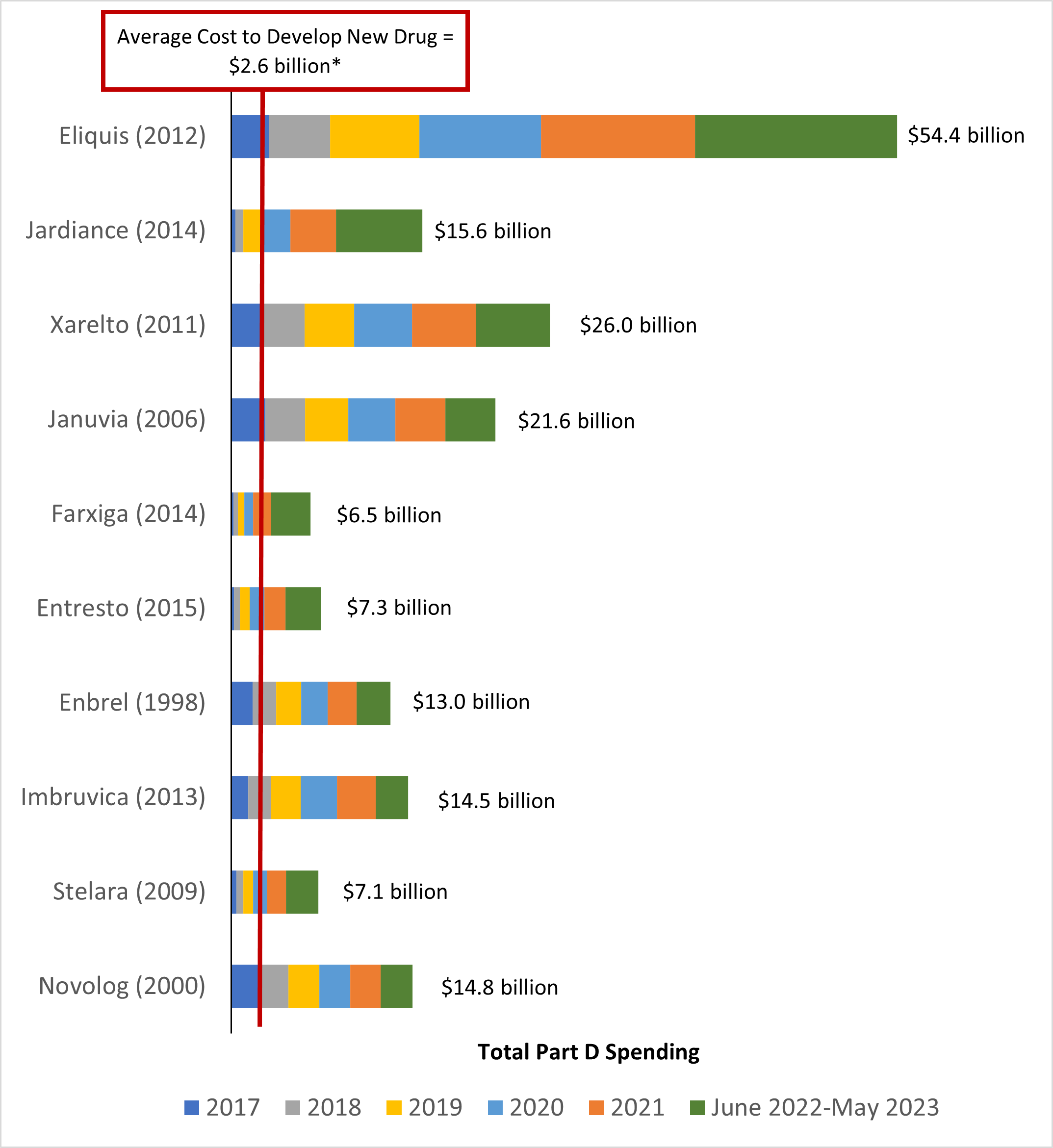

AARP’s Public Policy Institute examined total Medicare Part D spending between 2017 and May 2023 for the 10 drugs selected for the first round of Medicare negotiation.* We then compared total Medicare Part D spending over the six-year period to the drug industry’s estimate that it costs an average of $2.6 billion to develop a new drug, which includes the costs associated with drugs that fail to reach the market.

All of the selected Part D drugs had total Medicare Part D spending that more than doubled the average cost of drug development ($2.6 billion) over the study period. Nine of the 10 selected drugs had total Medicare Part D spending that exceeded the average cost of drug development in a single year (June 2022 through May 2023).

Eliquis, a prescription drug used to treat atrial fibrillation, had total Part D spending of $54.4 billion between 2017 and May 2023. This amount is more than 20 times the average cost to develop a new drug. Six other selected drugs had total Part D spending that was more than five times higher than the average cost to develop a new drug over the same time period.

On average, total Part D spending on the selected drugs over the six-year period was seven times higher than the average cost to develop a new drug.

Overall, the 10 selected drugs represented $180.7 billion in total Medicare Part D spending between 2017 and May 2023.

Figure 1. Total Part D Spending Greatly Exceeds Estimated Cost of Drug Development

Note: Total Medicare Part D spending data are not available for January 2022 through May 2022, making these totals an underestimate.

Source: AARP Public Policy Institute analysis of 2017–2021 data from the Centers for Medicare & Medicaid Services (CMS), Medicare Part D Drug Spending Dashboard and CMS, “Medicare Drug Price Negotiation Program: Selected Drugs for Initial Price Applicability Year 2026,” August 29, 2023.

Notably, this analysis only includes Medicare Part D spending; spending on the selected drugs is considerably higher once all US and non-US consumers are included. Further, based on their original FDA approval dates, the selected drugs have a minimum of two and maximum of eleven years of Medicare Part D spending that are not captured in this analysis.

It is also notable that the drug industry’s estimate that it costs $2.6 billion to develop a new drug has been subject to substantial criticism, and other researchers have estimated that drug development costs are considerably lower.

Conclusion

Drug companies have long argued that lowering drug prices through Medicare negotiation will stifle research and innovation. However, this analysis indicates that the revenue generated by just one taxpayer-funded program over a relatively short time frame still greatly exceeds the average cost to develop a new drug.** It is also notable that experts have said that—rather than cause harm—Medicare negotiation will help encourage the drug industry to focus on products that offer meaningful value to patients.

Criticisms of Medicare drug price negotiation must also be weighed against the consequences of maintaining the status quo. Research indicates that roughly one in five older adults engage in cost-coping strategies such as not filling a prescription or skipping doses to save money on their prescription medications. Medicare negotiation will help reduce the high prescription drug prices that are driving such behaviors and is even expected to help increase the use of Part D drugs, which will reduce spending in other parts of the Medicare program.

Medicare drug price negotiation also creates needed balance in the new drug law. Without lower drug prices to help offset the costs associated with limiting out-of-pocket costs, Medicare spending would increase and lead to higher beneficiary premiums that could eventually become unaffordable. These costs would also be passed along to all Americans through higher taxes, potentially harmful cuts to the program, or both.

Finally, it is important to emphasize that the benefits of Medicare negotiation extend well beyond the millions of enrollees taking the affected drugs. By lowering Medicare spending by billions of dollars, drug price negotiation will lower premiums for all beneficiaries and reduce costs for taxpayers who help fund the program, providing virtually all Americans with much-needed financial relief.

* Total Medicare Part D spending data are not available for January 2022 through May 2022, making these spending totals an underestimate.

** This analysis does not account for proprietary drug company rebates and other price concessions. Research indicates that only about one-third of brand-name drugs have more than nominal rebates and that there is substantial drug-to-drug variability. However, even if we assume a consistent rebate of 35 percent for every selected drug throughout the study period, combined total Medicare Part D spending between 2017 and May 2023 would still greatly exceed the average cost of drug development for all of the selected drugs in the analysis.