AARP Hearing Center

Surging Debt of Families Age 50+ Threatens Long-term Financial Security

By Lori Trawinski, March 16, 2022 07:51 AM

This blog is the first in a series that will examine the debt challenges faced by older families and will explore possible solutions to help older families manage their debt to achieve long-term financial security.

American families have been accumulating debt at a rapid pace over the past two decades, with the debt level nearly doubling. Yet family incomes have not kept pace. As a result, the long-term retirement security of many families is at risk. AARP surveyed working families in April 2021 and found that the two main barriers to people saving more for retirement are the lack of money (55 percent) and debt payments (44 percent).

Debt can be good or bad, depending on how much you have, whether you can make your monthly payments, and whether you feel that your debt situation is under control. Debt can be a useful tool to help you smooth your income vs. consumption needs throughout your life, by helping you attain things that you cannot pay for outright, such as a college education, a house, or a car. Over time, you pay down the debt and eventually pay off the loans.

Unfortunately, for many families, that does not happen. Instead of their debt growing smaller with time, their amount of debt increases. For older families who face this problem, many of whom have entered their retirement years, the consequences can be even greater. When this occurs, it can be difficult to keep up with monthly payments. And the debt is not just mortgages and home equity lines of credit; it is credit cards, auto loans, and increasingly, student loans.

Just how much has America’s debt burden grown, and how serious is the problem? Here’s a look at some telling numbers.

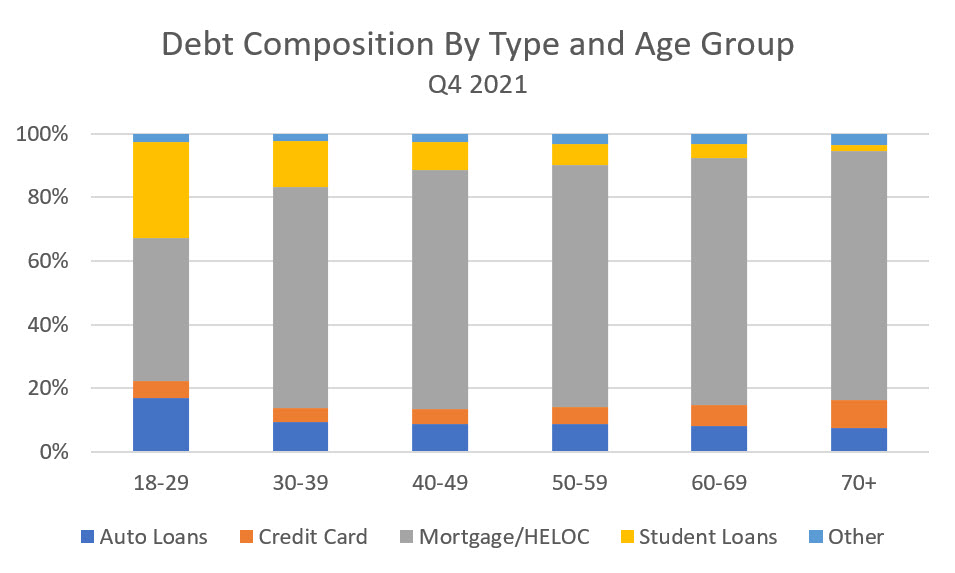

Total Debt Nearly Doubled Since 1999

Consumer debt in the United States totaled a whopping $15.58 trillion as of fourth quarter 2021, nearly double the $8.0 trillion (inflation-adjusted) owed in 1999. Mortgages and home equity lines of credit account for 72 percent of the outstanding debt. Student loans make up 10 percent while auto loans and leases account for 9 percent. Credit cards account for 5 percent and other loans, such as sales financing, personal loans, and store credit cards, make up the rest.

Source: New York Fed Consumer Credit Panel 2021 Q:4

Americans age 50+ owe $7 trillion, or 45 percent of the total consumer debt outstanding. Today, more families headed by someone age 50+ are carrying debt than ever before. Data from the Federal Reserve Survey of Consumer Finances (SCF) show that in 1998 nearly 60 percent of families age 50+ carried debt; by 2019, the percentage increased to 71.6 percent.

The incidence and amount of debt carried by 50+ families vary by race and ethnicity. In 2019, approximately 72 percent of White families age 50+ carried debt with a median amount of $60,700. Nearly 73 percent of Hispanic families age 50+ carried a median debt of $37,000, while 68 percent of Black/African American families carried a median debt of $22,000. Data for families of ethnicities such as Asian, Native American, multiracial, and others are not available separately.

Debt Burdens Take a Toll on Financial and Emotional Health

Increasing debt levels correspond with increasing debt repayment burdens. Debt burden is more than a current financial challenge, it also has an impact on long-term financial outcomes. As families spend more and more money on making debt payments, it leaves less money for other purposes, like saving for emergencies or retirement.

Many families today face very high debt burdens, or debt-to-total income ratios (DTI) calculated by dividing total monthly debt payments by total gross monthly income. In order to qualify for a mortgage, lenders typically require a DTI of 36 percent or less. Personal finance experts typically use a DTI of 40 percent as an indicator of high debt burden. AARP estimates that, among families that have debt, about 10 percent of families age 50+ faced a debt burden greater than 40 percent in 2019. In practical terms, this means families must devote over 40 percent of their gross income to debt payments. When you add other expenses, like taxes, food, medical care, and utility costs, many families have little, if any, income left for other purposes. And for those families age 50+ with annual incomes in the bottom quintile ($27, 489 or less), almost 23 percent faced a debt burden greater than 40 percent. Hispanic and Black/African American families age 50+ face much higher debt burdens than White families.

There is another aspect of debt burden that is sometimes overlooked: the emotional toll. Stress about finances can lead to depression, anxiety, and other health issues. Meanwhile, the emotional side comes full circle, inextricably intertwined with one’s finances, because how people feel about debt greatly affects their financial behavior. A recent survey conducted by the TIAA Institute found that feeling constrained by debt is strongly related to a lack of retirement saving and planning for retirement. For purposes of the survey, a respondent was debt constrained if their debt and debt payments prevented them from adequately addressing other financial priorities. The survey found that 26 percent of White respondents, 38 percent of Black/African American respondents, and 46 percent of Hispanic respondents reported feeling constrained by debt in 2021.

Debt in Retirement is Risky

Growth in debt carried by older families headed by someone age 75+ is particularly troubling. The percentage of families age 75+ carrying debt more than doubled between 1998 and 2019, from 25 percent to 51 percent. Mortgage debt accounts for the largest share, with 27.7 percent of age 75+ families carrying a median amount of $82,000 in 2019. But the incidence and amount of credit card debt and auto loans has also been growing for this age group.

Carrying debt can lead to stress particularly for retired persons, who typically live on a fixed income, if they cannot meet their monthly payments. And now in 2022, another concern looms on the horizon: The Federal Reserve has announced its intention to raise interest rates this year. For loans and credit cards with adjustable interest rates, payments will increase when the interest rate rises. Higher interest rates coupled with higher balances and higher required payments may lead to even greater financial difficulty for many families.

Managing Debt is the Key to Financial Success

To tackle debt challenges, consumers can take several actions that can address both their overall situation as well as some of the emerging ones for 2022. For example, consumers should try to prepare for interest rate increases. They can start by curbing spending where possible and checking with their lender to see if they negotiate a better interest rate. In addition, resources are available to help consumers manage their debt. AARP Money Map™ is a free tool that can help consumers navigate debt management decisions. Financial assistance programs can also connect consumers with resources. AARP Foundation provides links to helpful information on its Guide to Public Benefits page. There, consumers can search for benefit programs that may be available—programs such as the Supplemental Nutrition Assistance Program (SNAP) as well as those that provide help with prescription drug costs, health insurance, and assistive technology.