AARP Hearing Center

Few African Americans Take Advantage of Retirement Planning Products

By Felicia Brown, February 9, 2015 01:28 AM

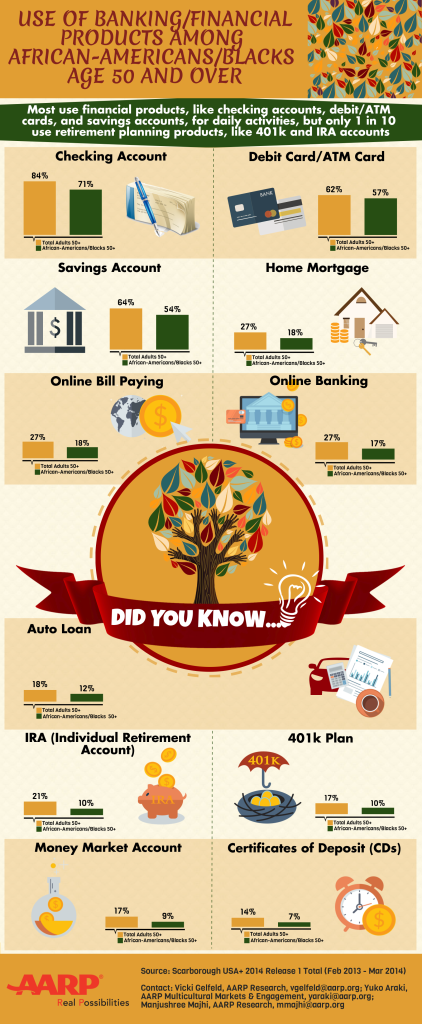

Recent research shows that most African Americans/blacks age 50-plus use financial products, such as checking accounts and savings accounts. But only 1 in 10 use retirement planning products, such as a 401(k) plan or individual retirement account (IRA). Millions of Americans haven’t saved any money for their golden years, and millions of others haven’t saved nearly enough. According to the Federal Reserve, the median balance of retirement accounts totals less than $60,000, and many African Americans/blacks have saved even less.

>> AARP Financial Freedom: News, Tips and Resources for Your Financial Health

But it’s never too late to start preparing for tomorrow. AARP’s free tools and unbiased resources can lend a hand:

- Don’t underestimate how much you will need to live in retirement. AARP’s Retirement Calculator can help get you on track so you can retire when — and how — you want.

- Be sure to account for the cost of health care. AARP’s Health Care Costs Calculator can help you estimate what you may have to pay out of pocket.

- If you have high amounts of debt that prevent you from saving for retirement, AARP’s Credit Card Pay Off Calculator can assist in showing what it will take to pay off your credit card balances and how you can meet your repayment goals.

- If you have access to an employer defined benefit plan such as a 401(k) or 403(b), make sure you are contributing up to the employer match — don’t leave free money on the table. AARP’s 401(k) Calculator can help you see the impact that your contributions and the employer match will have in growing your retirement.

- If you don’t have access to a traditional 401(k), consider investing in an IRA that can assist you in saving for retirement. AARP’s Traditional IRA Calculator can help you determine how much your contributions might amount to at retirement.

>> AARP Foundation Tax-Aide: Get free help preparing and filing your taxes

For more information about this research, please contact: Vicki Gelfeld, AARP Research, vgelfeld@aarp.org; Yuko Araki, Multicultural Markets & Engagement, yaraki@aarp.org; or Manjushree Majhi, AARP Research, mmajhi@aarp.org.

>> Get discounts on financial services with your AARP Member Advantages.

Felicia Brown is project manager for financial security at AARP.

AARP helps people turn their goals and dreams into real possibilities, strengthens communities and fights for and equips Americans 50 and older to live their best lives. Discover all the ways AARP can help you, your family and your community at AARP Black Community.

Also of Interest

- Civil Rights Songs in the Key of Freedom Still Resonate

- The Good News About Bad Habits

- Get Involved: Learn How You Can Give Back

- Celebrate Black History Month and Get 20% Off Membership Dues Plus a Free Gift When You Join AARP.

See the AARP home page for deals, savings tips, trivia and more