AARP Hearing Center

College Costs Aren't What They Used to Be

By Joe Valenti , June 3, 2019 03:11 PM

During the recent commencement address at Atlanta’s Morehouse College, speaker Robert F. Smith triggered a roar of cheers and even tears of joy when he announced he would establish a fund to pay off the student loan debt of the entire graduating class. The generosity of the surprise gift—estimated at $40 million for just 396 students—highlights just how massive student loan debt has become, and how significant the gift likely was to the students and their families.

How does one single college graduating class have so much debt, roughly $100,000 per student on average?

A new PPI report delves into that question, looking at the changes in college costs across generations.

Runaway Costs

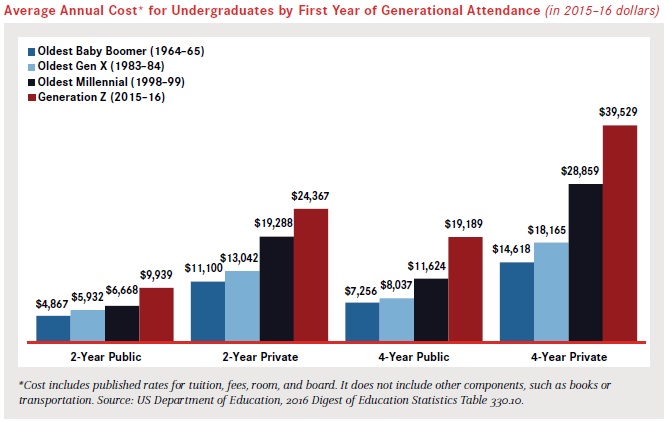

When the first Baby Boomers started college in 1964, the average cost of tuition, fees, room, and board at a four-year public school totaled $951 per year--$7,256 in today’s dollars. These costs have increased rapidly, particularly in the last three decades. For example, the first Gen X class in 1983 faced a published annual cost of just over $8,000 in today’s dollars. That compares to nearly $12,000 for the oldest Millennials and over $19,000 for the first Generation Z college students who started in 2015. Again, note that these increases are adjusted for inflation and thus show how college costs have risen well beyond costs across the economy. At private four-year colleges, published costs have increased at a similar rate.

While these published prices do not include financial aid, the net price that families pay has also increased consistently.

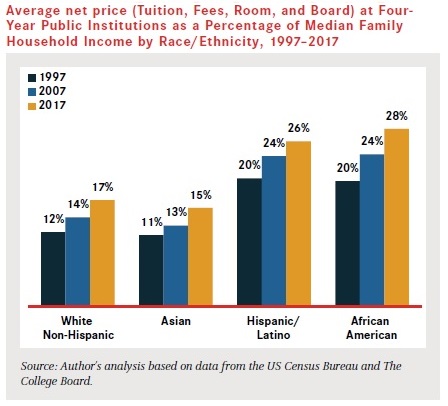

For many families, these costs are simply out of reach. The average net price at a four-year public institution now approaches 17 percent of the median family income for whites, 26 percent for Hispanics, 28 percent for African Americans, and 15 percent for Asian-Americans and Pacific Islanders. In other words, the cost of college does not comprise an amount that families typically can pay out of pocket or even save toward.

It is also beyond what most students could earn along the way. In the early 1980s, working 16 hours per week, year-round, at the minimum wage would cover in-state costs for a full-time student of modest means; today it would take 37 hours of work per week. As a result, college students, their parents, and other relatives have turned to borrowing, to the tune of $1.5 trillion in total student loan debt—$1 trillion more than in 2004.

There are different hypotheses for cost increases, from tightened state budgets to increasingly costly amenities like luxury dorm rooms and climbing walls. But the consequences are clear: reduced economic security across all age groups.

The Adult Burden

As another recent PPI report demonstrated, student loan debt is now an intergenerational problem. The average college senior with student debt owes nearly $29,000 at graduation, and then there is the burden that parents or other family members may owe.

Today, Americans over the age of 50 hold one of every five dollars of student loan debt. And over 100,000 Social Security recipients age 50+ lose part of their benefits in order for the federal government to collect on unpaid student loan debt, whether for them or for their children and grandchildren.

For young workers, student loan payments may lead to saving less for retirement, or not saving at all. PPI’s new report projects that recent graduates with student loan debt may need to work two to seven years longer just to reach the same retirement account balances as those graduates without student debt.

For the Morehouse class of 2019, Smith’s generous gift will help jumpstart their financial lives and repair their families’ balance sheets. But for millions of other students and their families, solving the college cost challenge will be an ongoing concern.

Joe Valenti is a senior strategic policy advisor at the AARP Public Policy Institute. His areas of expertise include, consumer debt, predatory lending practices, and access to safe and affordable financial products and advice.