AARP Hearing Center

The $400 Difference: What the Stimulus Revealed About the Power of Liquid Savings

By Catherine Harvey, May 26, 2021 12:55 PM

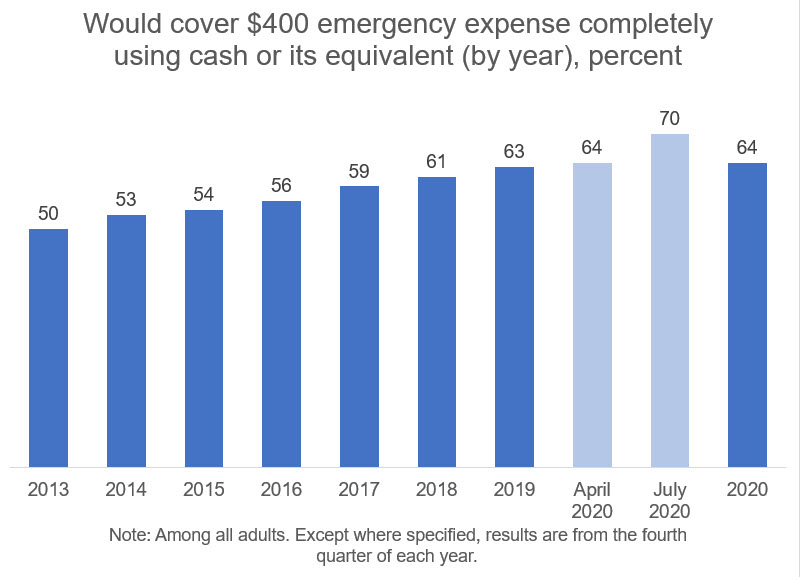

In July 2020, a few months into a global pandemic and the resulting economic upheaval, seven in ten Americans felt financially secure enough to handle a $400 emergency, a level of confidence unmatched in the history of the Federal Reserve’s survey of economic well-being.

This finding, tucked inside the Survey of Household Economics and Decision-Making, may not have been widely noticed because the 2020 end-of-year figures reverted to the same confidence levels as 2019. But it nevertheless highlights something to consider for its longer-term implications: how a few thousand dollars of liquid savings – in this case a federal stimulus payment – can make a profound difference in Americans’ financial well-being.

Source: US Federal Reserve, Economic Well-Being of U.S. Households in 2020, May 2021.

Stimulus Payment Boosted Households’ Financial Resilience

The $400 figure has become a bellwether statistic, seen as more in line with families’ financial realities than the stock market or unemployment figures. And the final numbers for 2020 are essentially unchanged from the prior two years, when more than three-fifths of households said they could cover such an emergency expense. But the Fed found the upward jump in confidence between supplemental surveys taken in April and July 2020 was due in large part to “financial relief and stimulus measures, including the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).”

Meanwhile, the 2020 aggregate data mask underlying disparities. Black and Latino workers were disproportionately less likely to be able to cover a $400 expense. Part of the reason concerns who lost jobs during the pandemic; historically, people who recently lost a job are especially likely to struggle with a $400 emergency, according to analysis by Anqui Chen at the Center for Retirement Research at Boston College. Sure enough, Black and Latino workers, especially women, have borne the brunt of job losses and resulting economic hardship during the pandemic.

Notably, the $400 challenge is not limited to the unemployed, nor even to workers with low earnings. Chen’s research finds that plenty of higher-income earners would also struggle to cover the expense, including a third of people earning between $75,000 and $100,000 (in 2017). These households may well have $400 in the bank but have already earmarked that savings for large debts like mortgages and student loans. A recent AARP survey confirms that debt continues to constrain households’ finances a year after the onset of the pandemic.

Liquid Assets Are Linked to Better Overall Financial Well-being

The fact that Americans’ overall confidence in being able to cover an emergency expenditure improved with economic impact payments and expanded unemployment insurance validates a growing body of evidence connecting more cash on hand to greater financial well-being.

People who routinely save in liquid accounts are more likely to experience a dramatic rise in overall financial well-being, according to new research from AARP by Jeremy Burke at the University of Southern California’s Center for Economic and Social Research. This is consistent with evidence from the Consumer Financial Protection Bureau, the Financial Health Network, and Morningstar, linking emergency savings to financial well-being. In the context of the pandemic, Burke also found that people who had lost income but received the first economic impact payment were less likely to experience a large decline in financial well-being than those who did not receive the stimulus. The buffering effect of the stimulus appeared to be even greater for Latino workers.

People are Better Off Even When They Spend What They Save

Lower-income households experienced the greatest gains in liquid assets, percentage-wise, from each round of the stimulus payments, according to the JPMorgan Chase Institute. These households were also more likely than higher-income households to spend that money faster.

That raises a relevant question: given that much of the money left households almost as soon as it arrived, should the stimulus payments be counted as savings? A growing crowd of researchers say yes. Savings is dynamic, and even when accounts are depleted, the “cycle of savings,” as the Aspen Institute calls it, still has lasting benefits.

Just a month’s worth of income saved can buffer low- to moderate-income households against food insecurity and other material hardship, according to new research from AARP by Jorge Sabat at the Universidad Diego Portales and Emily A. Gallagher at the University of Colorado Boulder. Even households that achieve this high-water mark of savings just once over a three-year period are significantly less likely to experience a decline in overall financial well-being over those years than households that never achieve that savings level. In other words, routinely depleting and rebuilding savings translates into greater financial resilience. Thus, any form of savings, regardless of how briefly it sits in the account, is, in fact, savings that can serve a meaningful purpose.

The Boost to Households’ Financial Well-being Doesn’t Have to Be Temporary

The federal pandemic relief policies provided a glimpse into a world where millions more people in the US had the liquid assets to cope with common emergencies. Not only did the stimulus payments help bring households back from the brink of food insecurity, eviction, and other hardship, they had another important but less visible impact: They contributed to consumers’ sense of financial well-being.

What’s also notable is that research suggests the benefits of these direct payments may last for years or more. While stimulus payments were intended as emergency policy measures, the effects of liquid savings on financial well-being need not be temporary. Policies and products that enable people to regularly build a modest savings cushion could make these temporary gains permanent.